featured insights & webinar

Asia USD Investment Grade Credits and Saudi Government Sukuk have outperformed in a global fixed income market that has been shaken by fiscal profligacy, geopolitical tensions, tariff uncertainties, and even oil market volatility. The Premia J.P. Morgan Asia Credit Investment Grade USD Bond ETF and Premia BOCHK Saudi Arabia Government Sukuk ETF have emerged from this stress-test as effective alternatives in portfolios – delivering stable income, and uncorrelated returns, while still trading at a spread over US Treasuries with further room for spread compression. Indeed, their higher yields of 4.8%-4.9% (4.8% for the Premia Asia Credit Investment Grade USD Bond and 4.9% for the Premia Saudi Government Sukuk) are outstanding, considering their lower corporate and government leverage, and comparable or superior credit ratings versus global peers.

Jul 24, 2025

Saudi Arabia’s tremendous transformation since the launch of the Vision 2030 strategic initiative has been accompanied by significant development of its capital markets – including its fixed income market which now offers some of the most attractive risk-adjusted returns in the government and investment grade fixed income space. In this article, we discuss about how our newly launched Saudi Arabia Government Sukuk ETF offers a timely alternative amid current market environment, and for sukuk investors and fixed income and multi-asset allocators stable income, attractive yield spread as well as uncorrelated returns.

Jun 22, 2025

China is undergoing a profound economic shift anchored in industrial upgrading and technological self-reliance. Amidst global macro uncertainties, the country's relentless focus on innovation across strategic sectors—ranging from semiconductors and artificial intelligence to robotics, green energy, and biotech—is building the foundation for sustained long-term growth. In this article, we discuss how these structural advances, often overlooked amid cyclical challenges, are already yielding tangible outcomes and positioning China at the forefront of the next wave of global industrial transformation. As policymakers are busy drafting the 15th Five Year Plan, and wrapping up the last stretch of the 14th Five Year Plan, it is also important to note how these innovation-led developments would continue to be at the forefront of the policy initiatives, and inform us of market opportunities ahead.

Jun 22, 2025

Amidst months of volatile global equity market performance and unprecedented trade policy uncertainty, the first quarter brought one of the most important events on China’s economic calendar: Beijing’s annual “Two Sessions” meeting, which offers a chance for officials to set economic targets and announce policy priorities for the year ahead. In this article, Dr. Phillip Wool, Global Head of Research of Rayliant Global Advisors, discusses how China policymakers are responding to Trump 2.0 tariff threats, and what it all means for A shares performance going into Q2.

May 07, 2025

The state of China’s consumer spending is better than how it has been portrayed in the media. Further, the latest developments and data suggest that the growth rate will get even better: The Chinese Government is placing more emphasis on domestic consumption as a driver of growth as global trade is disrupted by higher US tariffs. Meanwhile, the latest revenue figure from JD.com suggests a quickening of the pace of retail spending in the final quarter of 2024. The online retailer just reported 13.4% year-on-year growth in sales for the December quarter – the fastest growth rate in almost three years. This compares with its full year revenue growth rate of 6.8%, pointing to the rising growth momentum. In this article, we discuss about the consumption phenomenon in China, driving the decent growth of per-capita consumer spending in China at 5.1% YoY in real terms in 2024 (far higher than that of 1.8% in US).

Mar 20, 2025

It is worth noting that while the significant rally in BATJX – Baidu, Alibaba, Tencent, JD.com, Xiaomi – and the offshore listed tech/internet players have dominated headlines lately, the bottoming out of the overall China market since the policy shift in late September last year started onshore, with A shares experiencing a sharper rebound first and with a more slower but sustained trend, as domestic investors were more sensitive to the reset in policy tones and significant shift in government’s commitment to reviving economic growth and capital market activities. In this article, Partner & Co-CIO David Lai discusses the factors that could drive a more sustained outperformance in onshore equity market, and why it is a good entry point to rotate from offshore to onshore companies in policy supported sectors.

Mar 20, 2025

While the market is focused on the size of the fiscal stimulus emerging from the Two Sessions currently underway in Beijing, there are other important drivers that could shape the outlook for the relative performance of Chinese equities versus US stocks. The first is about relative valuation; the second is cyclical – that is, the turning of the US economic cycle; and the third is secular – that is, the sustainability of the repeated use of the “policy bazooka” in the US. In this article, our Senior Advisor Say Boon Lim discusses what causes the underperformance of US market since the Inauguration of President Trump, and diversification out of the US equities has become more important than ever while the slump in consumer confidence and potential debt crisis continue to add downward pressures on the US economy.

Mar 09, 2025

The Two Sessions have delivered a strong signal: China’s economy remains focused on steady growth, with robust government support, despite mounting global uncertainties. With an economic target of 5% growth for 2025 and the highest budget deficit in three decades, policymakers are set to implement a more proactive fiscal policy. This will include increasing government financing to drive domestic demand and boost private sector confidence. In this article, our Partner & Co-CIO David Lai highlights growth and policy supported areas to focus, during this ideal window to add exposure for Chinese equities, particularly opportunities from leaders in artificial intelligence (AI), semiconductors, robotics, and biotech that are still trading at attractive valuation via a via global and even offshore listed China peers.

Mar 09, 2025

After a stellar third quarter on renewed hopes of powerful fiscal stimulus, Chinese stocks followed shares in other emerging markets down in Q4, giving back some of those gains as the CSI 300 Index slipped 1.7% (CNY). Weighing on mainland stocks were investors’ fears that Trump 2.0 tariffs, along with a lack of follow-through by Chinese policymakers, might hinder the country’s growth revival. In this article, Dr. Phillip Wool, Global Head of Research of Rayliant Global Advisors, discusses what will spur Beijing to inject more stimulus, where it might go, and what Trump’s trade war and the DeepSeek saga might tell us about where A shares outperformance could come from in 2025.

Feb 24, 2025

Robust projected earnings growth for 2025 – part of a multi-year growth story driven by Artificial Intelligence – will give the Taiwan market a helpful buffer amidst geopolitical and trade uncertainties. Also, Taiwan has added protection from being the indispensable total supply chain for the tech industry – with its dominance driven by semiconductor and technology manufacturing leaders like TSMC, Hon Hai, and MediaTek. Economic growth is expected to remain solid at around 3.3% for this year. Beyond the tech sector, the government’s push to upgrade its financial services capabilities, with high domestic penetration and receptiveness of financial products, also provide promising tailwinds. The risks of Trump 2.0 make Taiwan a nuanced opportunity this year. It threatens volatility. But the AI revolution remains a multi-year growth driver, and Taiwan's strategic role, indeed global leadership in semiconductor manufacturing, offers strong long-term potential. Notwithstanding geopolitical considerations and general market risks, the medium to long term growth trajectory remains robust. In this article, our Portfolio Manager Alex Chu suggests that corrections could provide the long term investors attractive entry points into Taiwan’s technology-driven equity market which has a low correlation with global equity market as well as other major asset classes.

Jan 27, 2025

BY TOPICS

Chart Of the Week

Alex Chu

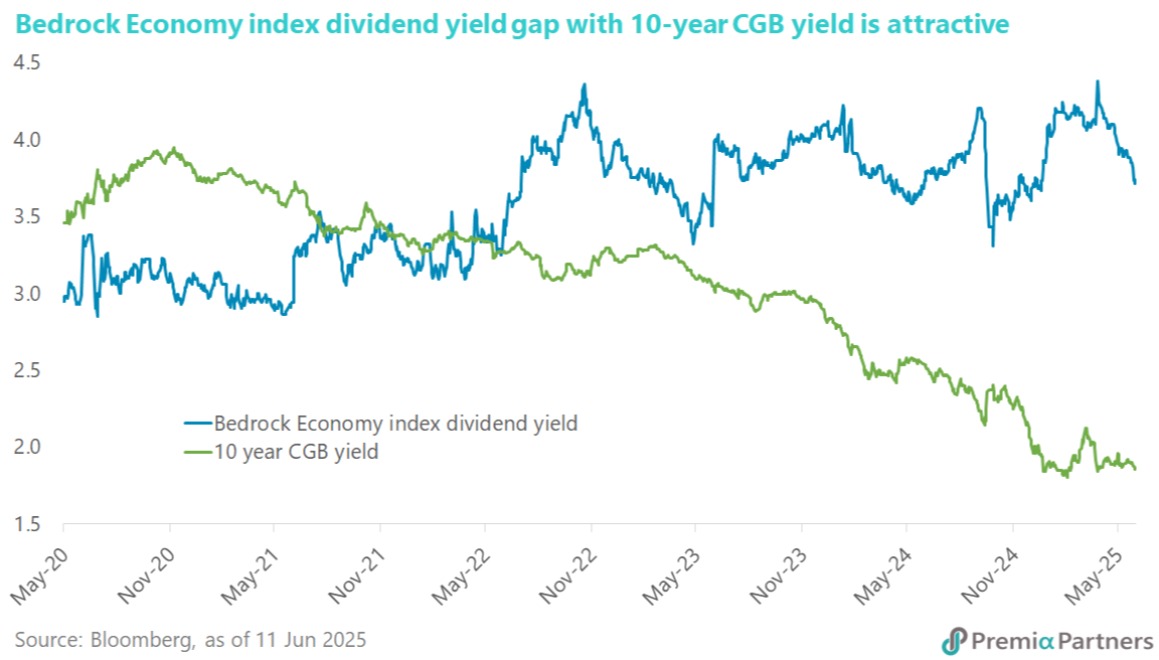

Chinese state-owned enterprises (SOEs) may gain traction again amid Chinese government’s commitment to stabilize the capital market, market value management implementation, and attractive yield against the government bonds. Central Huijin, often considered to be the national team, is approved by CSRC to be the new controlling shareholders of 8 small to mid-size financial companies, with an aim to stabilize the capital market and mitigate potential risks. Investors are also anticipating further policy support for the financial sector, expected to be announced at the Lujiazui Forum in Shanghai. This led to the strong capital inflow to nonbanking financials and outperformance of the sector. Moreover, a couple of SOEs have revealed their market value management plans or valuation improvement plans. Local brokers believed this trend will continue and gain momentum in the rest of this year, leading to the revaluation of these SOEs. On the short-term yield, China’s one- and three-year bonds fell to a four-month low due to heavy purchases of state banks. Onshore traders speculated that the PBOC was involved in the purchases. The PBOC’s potential purchases is one of the tools to bring liquidity to the market. As the bond yield drops and liquidity increases, the relatively higher SOE’s dividend yield would look appealing to investors, further supporting their share prices. To capitalize the above trend and diversify from growth related stocks, investors may consider our Premia CSI Caixin China Bedrock Economy ETF, which places a significant emphasis on SOEs, accounting for over 70% of its portfolio, benefiting from the government support and the potential high dividend yield.

Jun 16, 2025