In an October 6, 2020 Premia Partners Insight, we predicted that China would likely beat the then prevailing Bloomberg consensus of 2.0% GDP growth. Our forecast then was for 2.4% GDP growth. China has just announced its full year GDP growth rate at 2.3%.

8% GDP growth our forecast for 2021. Looking ahead, we are expecting around 8.0% GDP growth for China in 2021, against around 3% for the United States, 4.0% for the Euro Area, and 2.0% for Japan. The caveat and assumption are that China continues to successfully contain COVID-19 clusters that may break out from time to time.

China as world’s #1 economy by 2028? Continued effective management of the pandemic will then likely set China up to overtake the US as the world’s largest economy in US Dollar terms a year earlier than we had anticipated middle of last year. In an Insight published on May 13, 2020 , we wrote that Chinese economy should overtake the US economy by 2029 or 2030, depending on growth rate assumptions. We are now shortening that “catch-up” period by a year – to 2028 (on an optimistic growth assumption) or 2029 (on more cautious assumptions).

Notably, prominent UK-based economics consultancy, the Centre for Economics and Business Research (CEBR) recently predicted much the same.

In its “World Economic League Table 2021”, published on December 26, 2020, CEBR said: “The skillful management of the pandemic and the hits to long term growth in the West mean that China’s relative economic performance has improved. We now think that the Chinese economy in dollar terms will overtake the US economy in 2028, a full 5 years earlier than we thought last year.”

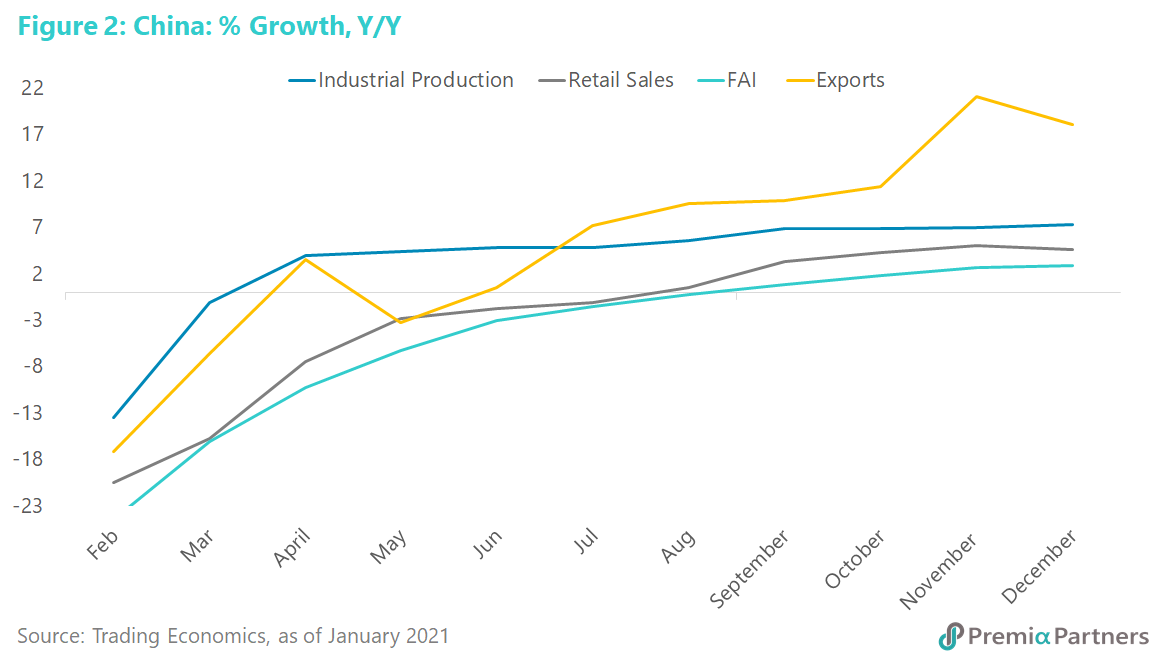

4Q20 sets a cracking pace for 2021. Significantly, 4Q20 GDP came in at 6.5% y/y, gathering momentum from 3.2% in 2Q20 and 4.9% in 3Q20 (figure 1). In contrast, the US economy spent 2Q20 and 3Q20 deep in negative territory, with contractions of -9.0% in 2Q20 and -2.8% in 3Q20, compared to the same quarter in the previous year. 4Q20 US GDP data had not yet been released at the time of writing.

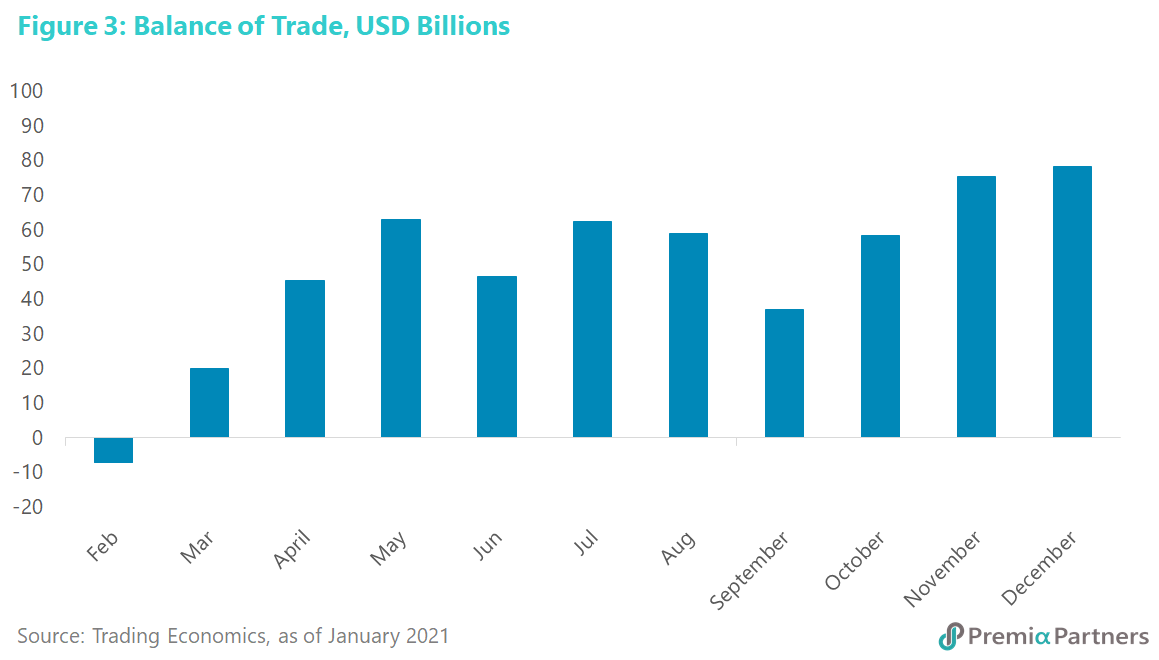

Sources of economic growth all pointing up. Retail sales growth, while pointing upwards, is still below pre-pandemic levels. Fixed asset investment growth kicked back up, but was kept relatively modest at 2.9% y/y, avoiding concerns of renewed “over-investment”.

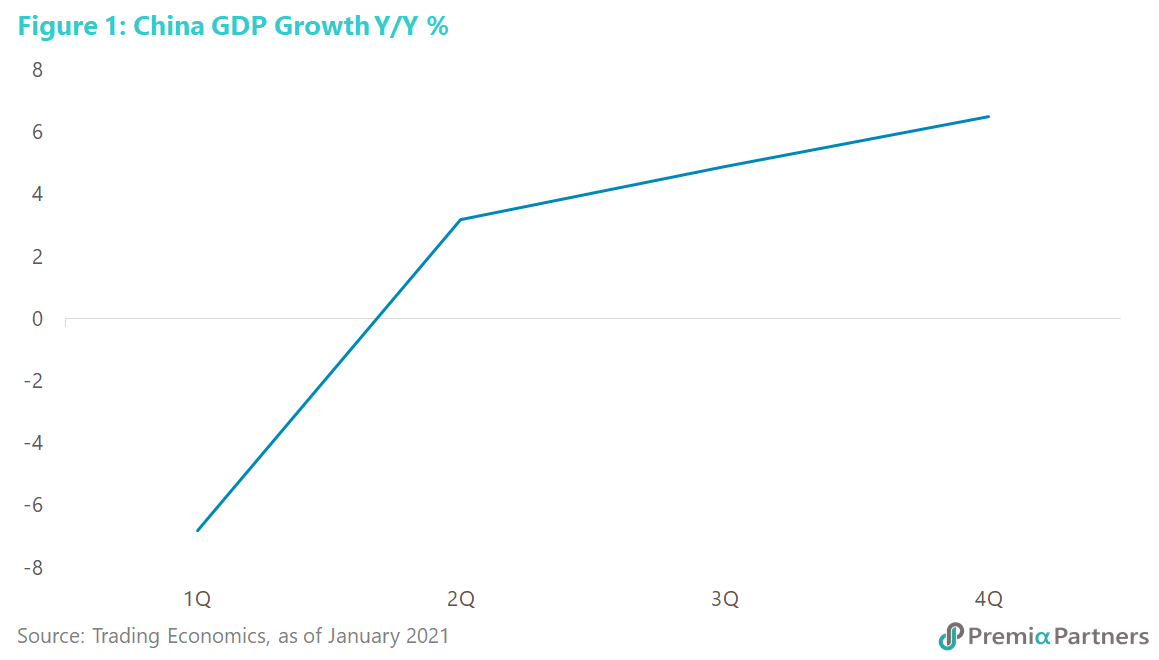

The indispensable heart of global supply chains. Industrial production growth has moved back to pre-pandemic levels, and remarkably, in the midst of a trade war with the United States, China’s export growth shot the proverbial lights out, breaking way above pre-pandemic levels (figure 2). As a result, China’s trade surplus hit a historic high of US$78.2 billion (figure 3).

This was made even more remarkable by a stunning 6.7% rise in the value of the CNY against the USD, which should have weighed against China’s export growth. All of which – amidst a trade war – raises important points about China’s competitiveness and China as the indispensable heart of global supply chains and manufacturing.

By the way, as Donald Trump (who reckoned “trade wars are easy to win”) retires to his golf course in Florida, he might note that China’s trade surplus with the US reached another record of US$317 billion in 2020.