精选观点 & Webinar

MSCI China A-shares inclusion is happening this week, but there are still a lot of global investors who hesitate to add China A to their portfolios. Over the last 12 months we’ve heard multiple reasons cited for this aversion to A-shares. In this post, we debunk the 10 most popular myths and highlight why the rational investor not only can, but should, allocate to A-shares, perhaps even ahead of MSCI’s multi-year inclusion plan.The 10 myths behind A-shares avoidance:1. China exposure is already covered via Chinese equities in HK & the US (offshore)2. All quality companies are listed offshore3. A-shares are trading at a premium to offshore Chinese equities4. A-shares have poor corporate governance5. A-shares are mainly SOEs whose interests do not align with shareholders6. A-shares add volatility only, without producing any long-term performance7. Renminbi is too volatile and always depreciates8. Rational investors should steer clear due to A-shares’ massive retail participation9. A-shares investment requires quotas and other complex processes 10. There isn’t enough research coverage.1. China exposure is already covered via Chinese equities in HK & the USFirst, the A-shares market has 3x the number of stocks available offshore. The daily turnover is 5x greater than both H-shares (HK) and ADRs (US) combined. In other words, the onshore market is the primary market, no matter what the global community may think. Some sub-sectors are even unique to the A-shares market only, namely aerospace and defense, Chinese distillers, entertainment & publishing, cable & satellite, precious metals, and many others. They are listed only onshore and include companies that many investors should be reviewing as part of their allocation to China in the 21st century. Conclusion: MythSource: Bloomberg as of May 21, 20182. All quality companies are listed offshoreFirst and foremost, this doesn’t hold up to scrutiny. China A-shares score similarly to many other global markets on metrics such as profit margin, ROA, ROE and current ratio. In fact, on all but ROA, China A-shares have a bigger quality exposure than MSCI World. In addition, many industry leaders are only listed in either Shanghai or Shenzhen, not offshore: Jiangsu Hengrui (pharmaceuticals), Midea (home appliances), Kweichow Moutai (beverages), China International Travel Services (leisure), and Shenzhen Inovance (automation), etc. If investors keep excluding A-shares from their radar screens, then they exclude many of the most recognized domestic consumer brands. Beyond the existing onshore listings, the launch of China Depositary Receipts (CDRs) in the coming months will encourage some offshore listed national champions to return home. In addition, the China Securities Regulatory Commission (CSRC) is speeding up IPOs of qualified unicorn companies in biotechnology, cloud computing, artificial intelligence, and high-end manufacturing. By then, the domestic markets will look even more complete and attractive. Conclusion: MythSource: Bloomberg as of May 21, 20183. A-shares are trading at a premium to offshore Chinese equitiesA-shares are trading at a premium? Yes, but only if looking at dual-listed A/H shares (the companies that are listed both onshore and offshore). The overall premium of dual-listed A-shares is ~20% over their dual-listed H-shares counterparts. But that is only part of the story.When looking at the overall market, the story is quite different. CSI 300, the main benchmark for China A, is trading at ~13.0x of forward PER versus MSCI China, the main benchmark for offshore Chinese equities, which is trading at ~13.4x. A-shares have a lower Price to Book and a higher Dividend Yield as well. Basically, both onshore and offshore China plays are trading at similar valuations. But that’s assuming mainstream benchmarks. At Premia, we follow the CSI Caixin Rayliant Bedrock Economy Index for our traditional economy ETF, 2803 HK (product page). A-shares investment looks even more attractive from a valuation point of view, when utilizing our approach. Conclusion: Partial MythHere’s another way to look at the dispersion. Mid/small-caps are currently trading in the ~10th-20th percentile in valuations relative to their own history. In contrast, mega/large-caps are trading in the 50th-60th percentile vs the last 10 years. Over a shorter horizon, mega-caps in particular look rich in the 75th-85th percentile vs the last 3-5 years.Source: Bloomberg as of May 21, 2018; China A: CSI300; Offshore China: MSCI China; Bedrock China A: CSI Caixin Rayliant Bedrock Economy4. A-shares have poor corporate governanceCorporate governance issues are not new or unique to China. They exist in every emerging market and developed market. Think about the recent global scandals such as Facebook’s leak of personal data, Samsung’s bribery issues resulting in the heir going to jail, the collapse of Lehman Brothers and AIG during the financial crisis, etc. The Chinese government and regulators have been stepping up efforts to ensure that a fit and proper corporate governance is in place for listed companies. A cumulative voting mechanism to protect minorities’ interests, a minimum proportion of independent directors and International Financial Reporting Standards have all been gradually introduced in the past. Even now, one could argue that corporate governance in China is no worse than in other EM markets, and is in fact getting better as the government has made tackling the issue a priority. Increasing foreign ownership can only help push the market in the right direction. Conclusion: Partial Myth5. A-shares are mainly SOEs whose interests do not align with shareholdersA-shares are mainly SOEs whose interests do not align with shareholdersAmong 3,608 listed companies in Shanghai and Shenzhen, there are only ~1,000 central or local SOEs, accounting for less than one-third of the total number of A-shares. Investors have plenty of choice when putting their money in non-SOE companies. That said, it is also overly simplistic to say that all SOEs are in bad shape, mismanaged or over-geared without proper due diligence. Corporate governance goes hand in hand with SOE reform, a priority for the government going forward. Some SOEs like Gree and Shanghai Auto already deliver good operating results and manage to outperform the broader market. Effective screening tools for selecting the right stocks is important, regardless of their SOE or non-SOE status. For more info on our approach, click here. Conclusion: Myth6. A-shares add volatility only, without producing any long-term performanceGiven the nature of emerging markets, China A-shares do have higher volatility compared to most developed markets such as the US, Europe and Japan. However, A-shares have also outperformed those markets over the last ~15 years. So while the volatility is higher, so too is long-term return, in line with modern portfolio theory. More recently, volatility has decreased and we expect it to trend down as the market becomes more institutionally driven. Besides, looking at volatility only without considering correlations is a largely irrelevant asset allocation exercise. Adding A-shares into one’s portfolio helps increase diversification due to the low correlation of A-shares with other markets. Conclusion: MythSource: Bloomberg, Premia Partners, as of December 31, 20177. Renminbi is too volatile and always depreciatesFollowing the internationalization of the renminbi, the IMF voted to designate the renminbi as one of several main world currencies, thus including it in the basket of special drawing rights. An ongoing renminbi devaluation for the sake of increased exports is a misleading accusation. China is in the middle of transforming its economy from being export-oriented to domestically focused. Currency depreciation does not make long-term sense in that context. This is one of the reasons why the basket of currencies maintained by the State Administration of Foreign Exchange has been expanded to all their trading partners, rather than just USD. But all these points pale in comparison to an even simpler way of proving this concern false – the data. The renminbi appreciated by more than 7.4% in USD term in the past 12 months. Conclusion: MythSource: Bloomberg as of May 21, 20188. Rational investors should steer clear due to A-shares’ massive retail participation90% of daily turnover comes from individual investors in China A whilst less than 10% in the US. This is true. Similar to individual investor behavior in developed markets, retail flows in China lean toward stocks that are small, growth biased, lottery in nature and high beta, etc. These elements lead to higher volatility and unpredictability. That said, retail investors in China offer opportunities for professional investors to outperform, just like in developed markets. Inefficiency and behavioral errors create opportunity for capturing alpha, both through capable active management and through well-researched smart beta strategies. Conclusion: Partial MythSource: Rayliant Global Advisors, Premia Partners as of May 31, 20179. A-shares investment requires quotas and other complex processesForeign investors used to invest in China A through either Qualified Foreign Institutional Investors (QFII) or Renminbi QFII. Each institution had to apply for its own quota to trade physical A-shares. But as Chinese regulators decided to open their capital markets to global investors, the Stock Connect program was introduced in November 2014. It is a more flexible scheme that does not require individual investor quotas. No applications or complex processes are required – a total of 1,485 A-shares listed in either Shanghai or Shenzhen is available for trading through Stock Connect on the Hong Kong Stock Exchange. Conclusion: Myth10. There isn’t enough research coverageThere are 3,608 A-shares listed in either Shanghai or Shenzhen with most of the names not recognizable by many foreign investors. Given the above concerns, it’s understandable that global investors wouldn’t be satisfied with a passive approach and prefer active management instead. But with so many stocks, it’s easy to get lost without investing material resources in research. This is where Premia can step in and help. 7 months ago we built two solutions to tap into different segments in China whilst capturing excess return. The Bedrock Economy strategy (2803 HK) focuses on stocks that are the backbone of the Chinese economy whilst the New Economy strategy (3173 HK) taps into the future growth story of China including consumption upgrades, technological advancement and aging population. Both strategies not only focus on those two different aspects of China A-shares, but then screen each universe to identify stocks that offer long-term excess return. Bedrock focuses on value, quality, low size and low volatility companies while New Economy prioritizes asset-light, quality and R&D focused firmsComparing the latest disclosure of the 234 index constituents for MSCI China A Inclusion, the following is an analysis of index correlation, stock and sector overlap with the underlying indexes of Bedrock Economy and New Economy. Bedrock Economy (2803 HK) has a much higher correlation and more stock overlap with MSCI China A Inclusion. If you’re aiming for excess return vs MSCI China A Inclusion but don’t want to deviate significantly from that benchmark, the 2803 HK would be the right choice. On the other hand, New Economy (3173 HK) offer a drastically different exposure, focusing more on Information Technology, Consumer Discretionary and Healthcare sectors. If you’re aiming to steer clear from large-cap SOEs and to prioritize China’s future rather than today’s economy, than 3173 HK may be the exposure for you. Conclusion: Partial MythSource: Bloomberg as of May 21, 2018Out of 10 common reasons for not investing in A-shares, we score 6 as complete myths, not based on current facts about A-shares. The other 4 are partial myths, where choices of data drive the outcome or where the facts are true, but the implication isn’t. In our view, gone are the days when A-shares as a market can be ignored. Investors need to allocate to A-shares in their portfolios, or risk decreasing their diversification and leaving opportunities for alpha on the table.Regards,David

May 28, 2018

Much has been made of the “copied in China” story over the last 1-2 decades. That perception is starting to shift, but ever so slowly with a lot more to be done. In this note, I take a look at the status of innovation in China, China’s ranking vs global peers, and how our ETF, 3173 HK, takes aim directly at China’s R&D and innovation companies (product page here and overview page here).

May 16, 2018

The first quarter of 2018 was a story of 2 halves. January was an aggressive move up in global markets, including A-shares across the board. It was essentially a continuation of 2017, with many of the same factor and sector performance dynamics. The correction from early February onward put a stop to that momentum trade, with A-shares seeing a wholesale rotation to different factor/sector results. Our New Economy and Bedrock ETFs underperformed in January but made up significant ground in February and March, so much so that New Economy (3173 HK) was one of the few A-shares strategies to deliver positive returns in Q1. Q1 overallChiNext led the market with a positive of 8.5% whilst FTSE A50 was down by 4.2%. A complete reversal of 2017. The A-shares market overall trended down with other global markets and the mega-cap rally ran out of steam. Sector wise, new economy sectors such as health care and information technology managed to have a positive return of 10.1% and 1.3%, respectively. All other sectors were negative, with telecom and consumer staples leading at -13.2% and -8.0%. All of this happened in February and March, with January looking like a continuation of 2017 – strong performance from financials and mega-caps. Momentum was king. But as the global correction got under way, it was the recent leaders that fell first. Investors began to take profit on their winners and refocused allocations to new economy and mid/small-cap stocks. The movement was in sync with policy agenda at the Two Sessions, held in March, emphasizing a shift in the economic growth model to focus on quality instead of quantity of growth. It was also in line with increased trade tariff rhetoric – new economy and smaller stocks are less exposed to global trade dynamics. Q1 performance by market cap Source: Bloomberg, as of 2 April 2018 Q1 performance by sector Source: Bloomberg, as of 2 April 2018 Factor resultsGoing forward, thanks to our friends at Rayliant, we will also include comments on factor patterns as well as traditional sector and macro drivers of returns. During the quarter, factor returns were subject to the same January vs February/March dynamic. January was led by Value and Low Risk, while Size suffered. This is in line with FTSE A50 outperformance, given mega-cap financials are not overly rich and score well on low volatility given their one-way performance in recent years. February and March witnessed completely different factor dynamics, with Value and Low Vol retreating into negative return territory by quarter-end. Instead, Quality and Growth ended the quarter positive and Size recovered nearly all of its January losses. Source: Rayliant Global Advisors, as of 10 April 2018 What will we see in the rest of 2018? January or February/March?Given the starkly different dynamics, many clients asked for our thoughts on which version of A-shares we expect to see going forward. Should we position for January or for February & March. Wihle there is no crystal ball to answer this question, we do have some compelling long-term data that points to February & March being the norm. Below are data points for Jan, Feb/Mar, 2017 and 10Y returns through the lens of market cap and sector allocations.Market cap – 10Y returns point to 2017 & January mega-cap outperformance being an outlier: we expect broader market cap exposures to continue to outperform. Source: Bloomberg, Premia Partners, as of 26 Jan 2018 Sectors – the last 10Y have been led by healthcare, consumer and technology stocks. It’s not lost on us that this is the exact composition of 3173 HK, though we have to admit we are a bit embarrased not to have built this chart earlier on. Source: Bloomberg, as of 2 April 2018 Relative Value in Large vs SmallThe biggest shift of the quarter was of course in the small vs large trade. We’ve been talking about this for a while, pointing out that both valuations and recent performance suggest that it might be time to underweight mega-caps. To recap, mid/small-caps retrenched from their 2015 peak to a PE sub 30x while mega and large-caps continued to trend up (left chart). The gap in large/small valuations is close to all-time tights – you can barely see the February/March correction in relative valuations (right chart). There is still more room for this relative value trade to run. PE Ratios Source: Bloomberg, Premia Partners, as of 2 April 2018 Here’s another way to look at the dispersion. Mid/small-caps are currently trading in the ~10th-20th percentile in valuations relative to their own history. In contrast, mega/large-caps are trading in the 50th-60th percentile vs the last 10 years. Over a shorter horizon, mega-caps in particular look rich in the 75th-85th percentile vs the last 3-5 years. Relative Historical Valuations Source: Bloomberg, Premia Partners, as of 2 April 2018 Premia A-shares ETFsIn terms of our ETFs, now that we have our first full quarter behind us, we can start to look back at their behavior. Here’s a quick summary of what you need to know:Summary statistics at quarter-end (in US$) – slow but steady growth in AUM and turnover. We saw multiple creates in both ETFs and an improvement in turnover from January to March. Source: Bloomberg, Premia Partners, as of 2 April 2018 Premium/Discount relative to other ETFs – despite launching less than 6 months ago, both 2803 HK and 3173 HK held their own in terms of premium/discount levels vs the more established ETFs. 2803 HK and 3173 HK averaged -0.28% and -0.05% in discount since inception. Don’t worry if you can’t spot the Premia ETFs immediately without looking at the legend. That’s the point – their premium/discounts are in line with the leading A-shares ETFs. Source: Bloomberg, Premia Partners, as of 2 April 2018 Index Return vs mainstream indices – The CSI Caixin Rayliant New Economic Engine Index (the index used by 3173 HK) outperformed all 3 of the major benchmarks (FTSE China A50 Index, CSI 300 Index, MSCI China A Inclusion Index) while the CSI Caixin Rayliant Bedrock Economy Index outperformed two of the three. Unsurprisingly, relative performance tracked the earlier-mentioned dynamics – underperformance during January and outperformance in February and March. Source: Bloomberg, as of 2 April 2018 3173 HK Performance Drivers – 2 things dominated returns: strong performance from its key sector exposures and its overall exposure to smaller stocks given its all-cap universe. Below is a Bloomberg attribution of returns for 3173 HK over 1Q18. Source: Bloomberg, as of 11 April 2018 The single biggest contributor was selection within the tech sector. Note that even though the overweight was high, it wasn’t the allocation to the sector that drove returns, but the selection of stocks, i.e. both our smart beta application and our all-cap approach (tech stocks not available in CSI 300). The financials underweight and healthcare overweight benefited performance, though selection from both sectors had a muted impact. Lastly, the consumer discretionary overweight and selection also contributed to returns.2803 HK Performance Drivers – the story is quite different for 2803. It underperformed slightly vs CSI 300 during the quarter, but the drivers were quite widespread. The average over/under-weight for each sector was ~2%, which resulted in minimal performance impact from allocation. Security selection in real estate, healthcare and consumer discretionary, however, hurt returns. A stronger impact from selection makes sense for 2803, given its active share of 48% vs CSI 300 and only 154 stock overlap. Source: Bloomberg, as of 11 April 2018 ********* Apologies for the long read. This was our first quarterly update and we’ll get better at them. Hopefully it was useful, and as always, should you have any questions, don’t hesitate to ask.

Apr 11, 2018

The topic of “trade war” seems to be dominating the market headlines lately with global equities weakening on poor sentiment. Should everyone simply sell their holdings and take a long vacation? It’s certainly important to be cautious and to consider downside risks. It might not be the worst decision for those who can take profit from the strong rally late last year and early this year, especially if there is no benchmark to worry about. However, adopting such a pessimistic approach and setting “risk avoidance at all cost” as a primary investment focus may result in many great opportunities missed. Indeed, even in today’s negative climate, we find some interesting movement in China A-shares that may help investors generate positive returns while overall markets are flat or down. On 22 Mar 2018, Trump signed an executive memorandum that would impose tariffs on up to USD 60 billion in Chinese imports. Global markets reacted with fear of a potential slowdown in the global economy with major indexes dropping the next day. The A-Shares market was no exception. Intriguingly, mega-to-large caps and mid-to-small caps reacted differently since then. Mega-to-large caps (FTSE A50 and CSI 300) fell immediately and continued down afterward whilst mid-to-small caps (CSI 500 and ChiNext) rebounded and even managed to record a positive return. It’s important to understand the difference in the universe of stocks before making decisions on the what and how of an A-shares allocation. Changes since trade war: mega-cap -5.5%; large-cap -3.3%; mid-to-small cap +0.3%; ChiNext +4.6% Source: Bloomberg as of 2 April 2018 Undoubtedly, most of these outperforming stocks come from segments that have less influence from overseas sales, such as semiconductor, IT services and health care. All 3 segments recorded a positive return during the down market. They are not only considered as defensive during the current trade war but also viewed as beneficiaries from the increasing tension in the bilateral trade between the US and China.Sector performance since trade war: Semiconductor +8.3%; IT Services +7.9%; Health Care +1.6% Source: Bloomberg as of 2 April 2018 The first outperforming segment that comes into our sight is Semiconductor. After the outbreak of the trade war, China may encourage the use of domestically developed semiconductor products rather than those imported from the US. One such product is the Graphics Processing Unit (GPU). Currently the world’s largest and leading GPU manufactures are mostly US companies, such as Nvidia and AMD. GPU not only plays an important role in gaming but also in the area of Artificial Intelligence (AI) and Cloud Computing. Since China advocates AI and Cloud Computing as future growth drivers, the demand for GPUs will remain high regardless of a trade war. At the company level, Changsha Jingjia Microelectronics (300474 CH), a domestic leading GPU manufacturer with strong research and development capabilities, may benefit from the switch. Zhejiang Jingsheng (300316 CH), a high-tech enterprise in semiconductor silicon material, PV silicon material and related equipment, would also gain from the potential change.Following the same logic, the IT Services segment had a great rally as well. One of the key sectors targeted for tariffs by the Trump administration is technology. It is highly likely that future sanctions may involve punishing Beijing over technology transfer policies. Separately, the State Council issued new guidelines last week that technology exports and Intellectual Property (IP) transfers that are part of acquisitions made by foreign firms involving patents, integrated circuit design and computer software copyright will be subject to national security checks. Going forward, domestic software companies such as Beijing VRV Software (300352 CH) and Xiamen Meiya Pico Info (300188 CH), focusing on information security software, may continue to take advantage of the government’s support to homegrown players.On the healthcare front, the National People’s Congress just passed a proposal to establish a National Health Commission, combining the functions of some former agencies. The main aim is to cut bureaucracy and implement a Healthy China strategy. China will move from a disease treatment approach to a preventative model. It is highly likely that the new agency will lead efforts in improving the medical services and insurance systems, while applying AI and Big Data technologies to promote precision medical treatment. Winning Health Technology (300253 CH) focuses on digitalizing medical information and applying AI and Big Data analysis in hospital and public health, while Autobio Diagnostics (603658 CH) specializes in R&D and production of clinical diagnostic products covering immunoassay, microbiology and biochemistry. Since most of their current and potential customers are domestic and would not be affected much by the trade war, it is not surprising that they managed to outperform after markets digested the initial news flow. Stocks from semiconductor, IT services and health care recorded decent gain in a down market Source: Bloomberg as of 2 April 2018 It’s not hard to notice a few similarities among these highlighted companies: (1) all of them are mid-to-small caps, (2) they have negligible overseas revenue, (3) most of them are listed in ChiNext, (4) they all belong to China’s new economy sectors. Because of the latter, they qualify for the Premia CSI Caixin New Economy ETF (3173 HK) which outperformed the broader market materially during this period. Source: Bloomberg as of 2 April 2018 We expect the development of a trade war to carry on in the next few months, causing ups and downs in global stock markets. It is hard to tell what path the negotiations and public rhetoric will take. From a macro point of view, we do see a silver lining in that China will further prioritize the development of domestic demand and will speed up innovation across many aspects of its economy. Aligning with its Made in China 2025 strategy and the national interest to become a tech superpower, it is time for Chinese companies to invest more in research and development. As investors, we see this as an opportunity to invest alongside government priorities and initiatives. As Warren Buffett once said “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” We recommend embracing the change and using depressed overall market values to reallocate to your desired 3-5yr horizon positions, riding along the up-and-rising Chinese companies. Regards,David, Alex

Apr 06, 2018

We are in the middle of China’s “two sessions” and have seen a host of news and market adjustments over the last 5 weeks. 3 themes stand out – a commitment to 6.5% growth, a focus on national champion repatriation, and the beginning of a rotation away from mega-caps toward broader market cap exposure.

Mar 08, 2018

Last week on Thursday, we held a call moderated by Henny Sender of the FT with Prof Zhiwu Chen of HKU and David Lai from Premia Partners to discuss the future of China’s economy and markets. Below is a summary of the call, which covered the implications of quality vs quantity growth, SOE reform, the role of tech in China, risks on the horizon and what we expect going forward.

Feb 01, 2018

As we cross 3 months post listing, we take a look at the state of both China A-shares smart beta ETFs and ask our colleagues for recommendations in picking between the two.

Jan 29, 2018

In this insight, we review the status of Stock Connect. The low daily utilization hides the fact that Stock Connect has reshaped China investing. We look at who's buying what, why, and how much while also exploring where the program is headed.

Jan 17, 2018

A-shares outperformed most developed markets during 2017. In this update, we review the drivers of 2017 performance, the opportunities and challenges in 2018, and the risks we should be mindful of. Our conclusion?China outperformed most DM markets during its mid-2017 onward rallyMega-caps and Consumer Staples outperformed, reflecting investors’ focus on stability and concerns with debt (which we believe are completely overblown)We expect 2018 conditions to support strong equity market returns in ChinaDeleveraging and quality vs growth focus will be balanced and targeted, not destabilizingHealthy earnings growth, a supportive global macro economy and low A-shares valuations are conducive to a positive outlookRetail inflows to equities are likely as investors are pushed to stocks by a crackdown in “alternative” savings productsOur predictions for China A-shares in 2018:A-shares will outperform DM and likely broader EM / offshore China stocksDomestic and foreign inflows into A-shares will be strongMid-small caps will post decent positive returns, likely mean-reverting to outperformance vs large-capsOur favorite themes going forward include consumption upgrade/premiumization, social welfare, electric vehicles, industrial automation and IT backbone infrastructure2017 RecapNow that 2017 is nearly over, we’d like to review the China market over the past 12 months and explore what opportunities and risks await us in 2018. 2017 was characterized by an overall increase in risk appetite for equities since the beginning of the year, with positive sentiment eventually spreading from the US to global markets, particularly EM. China’s A-share market is no exception to this, though its rally lagged by a few months. The long-awaited announcement of A-shares inclusion into MSCI Emerging Markets Index was the catalyst that triggered the strong run from mid-2017 to today. Since then, China A-shares managed to outperform most developed markets, including US, Europe and Japan. Source: Bloomberg as of Dec 11, 2017Go Big or Go HomeWhen looking closer at the A-shares market, the diverging performance among mega-caps, large-caps, mid-caps and small-caps is hard to miss. The former two segments had a decent gain whilst the latter two were either flat or loss-making year-to-date. Source: Bloomberg as of Dec 11, 2017Note: Mega-cap: CSI100 Index, Large-cap: CSI200 Index; Med-cap: CSI500 Index, Small-cap: CSI10000 Index As we have been saying the past 6 months, investors are no longer worried about a potential massive economic slowdown, any one-off depreciation of yuan or uncontrollable capital outflows. This lack of worry explains the positive return recorded among mega-caps and large-caps. On the other hand, some market participants remain cautious as both the International Monetary Fund and local government officials voiced concerns about the Chinese financial system’s vulnerability from high leverage. China’s total debt increased from 164% of GDP a decade ago to today’s 259% of GDP. Economists now estimate the figure may go over 300% by the end of 2020, which may put China in the danger zone for a financial crisis. This limited investors’ all-in risk-taking mindset, resulting in strong security selection bias towards the larger stocks and avoidance of the mid-to-small cap segments so far.Our view differs. We think the debt issue is exaggerated and does not pose any imminent risk. Investors forget that over 60% of the country’s corporate debt belongs to state owned enterprises (SOEs). Government lending to government, left hand to right hand. It is unlikely that the Chinese government would not bail out an SOE if systemic risk issues arose. At the same time, the authorities are pushing SOE reform by developing mixed ownership of SOEs via privatization of state assets and debt-equity swaps, seeking to decrease inefficient leverage in the system. Lastly, investors seem to forget that 259% of GDP is not that big a number when thinking in total debt to GDP terms. The US, for example, is not better. The Federal Reserve estimates that domestic non-financial debt outstanding was $48.6T. GDP is $19.5T. If my math is right, that puts the US at 250% of GDP, and that’s not even considering financial debt. China doesn’t seem that worrisome in comparison. Bread and Butter were the standout sector in 2017From a sector point of view, Consumer Staples led the market by a large margin, recording a gain of 75.2% year-to-date. Three new economy-focused sectors, such as Information Technology, Consumer Discretionary, and Healthcare, performed in-line with the market whilst Utilities, Energy and Industrials underperformed. Traditional economy underperformance is not surprising given the rebalancing of China’s economy toward services. The surprise was Consumer Staples’ place atop the leaderboard, likely driven by a policy focus that emphasized “Financial Stability” over “Financial Innovation” throughout the year, forcing investors to prioritize Consumer Staples over new economy sectors. Source: Bloomberg as of Dec 11, 2017 2018: Full Steam AheadLooking ahead to 2018, we expect most of the positive factors to still be in place for China over the next 12 months. Externally, the global economy has continued its steady recovery, providing a solid foundation for equities. The absence of a GDP target indicates China is shifting from high growth to high quality development, with priorities being given to controlling systemic risk, narrowing the gap between the rich and the poor, promoting regional development, fighting against corruption and protecting the environment. Despite this quality over growth focus, China’s economy will expand by 6.8% in 2017 and 6.4% in 2018 based on consensus data. The growth rate is 3x that of DM, behind only India among the major economies globally (though off a much higher base than India!). Source: Bloomberg, Consensus forecast, as of Dec 11, 2017 Since bottoming out in mid-2015, China’s industrial enterprise profit continued to rise and reached the highest level in 7 years, underscoring resilience in the economy as authorities intensify their efforts to cut excess capacity and reduce pollution. This gives the government plenty of room to focus on over-supply and deleveraging, while balancing those long-term goals vs short-term pain. Robust producer-price inflation, improving output and consumer spending have been supporting the expansion and will likely keep it on track. It is expected the momentum will carry on in 2018, although the pace of growth may slow down slightly. Source: Bloomberg, National Bureau of Statistics of China, as of Dec 11, 2017 Reasonable Valuations and Healthy GrowthOn corporate earnings front, things look encouraging with earnings growth of 14.8% expected for the year of 2018 versus 10.0% in the US, 12.4% in Japan, and 6.5% in the UK. At a sector level, all China sectors are expected to achieve at least double-digit growth rates, although financials will be the slowest one. Banks’ profit has been in a plateau since 2014 and is unlikely to move materially over the next 12 months. Source: Bloomberg, as of Dec 11, 2017Note: Sectors: GICS classification; China A: CSI300 Index Overall valuations are relatively attractive as forward P/E is only 13.5x versus mid-to-high teens for major developed and emerging equities markets globally like the US, Japan, and India. It is not out of the question that we see an upward re-rating of China A-shares given this healthy growth profile. Source: Bloomberg, as of Dec 11, 2017 Lastly, the forward free cash flow yield spread between equities and the 10-year government bond yield remains historically high. The last few years have been characterized by bond market inflows and equity market outflows, not just globally but in China as well. The yield advantage of equities may justify a reversal of this trend, driving inflows into equities and making A-shares a very promising exposure for 2018. China’s authorities have been cracking down on “alternative” investment opportunities for retail investors, making A-shares a logical destination going forward. As an example, wealth management product sales are slowing as regulations are tightened. The government earlier cracked down on insurers that were selling wealth management products with guaranteed returns, on concern that their funds were channeled into war chests that funded aggressive acquisition and speculation. Several insurers already had their licenses revoked, or closed. Similarly, financial institutions were ordered to stop promising returns on their products, based on a set of preliminary regulations drafted a month ago by five Chinese regulators overseeing securities, banking, insurance, foreign exchange and the central bank. Traditional equity returns have been good, the number of brokerage accounts is increasing, and retail investors are likely to funnel money into equities in the absence of other alternatives. Source: Bloomberg, Jefferies, as of Dec 11, 2017 Our thoughts for 2018We would like to make a few predictions for the year of 2018: (1) China A-share will continue to outperform developed markets on solid macro environment and earnings momentum; (2) There will be actual domestic and foreign inflows into equities market, reversing the net outflows in the past couple of years since A-share peaked out in mid-2015; (3) Mid-and-small-caps will record a decent positive return if not outright outperforming large-caps on low valuation and mean reversion. Size is a particularly interesting factor to consider. The gap between mid-small caps and large cap performance is at global financial crisis levels. On a 1Y and 3Y rolling basis, mid-small caps typically outperform large-caps by 5% and 25% respectively. Yet today, those gaps stand at -20% and -29%. We believe there is a high probability of mean reversion in mid-small cap vs large cap performance. Mid-small cap is where much of the growth is coming from, and with SOE reform and potentially deleveraging, it is the inefficient large-caps that are likely to pull back relative to private sector mid-small caps. Source: Bloomberg, as of Dec 11, 2017 Themes to watchStocks and sectors with exposure to the following themes are likely to be a focus for investors in 2018:Consumption upgrade/premiumization: middle class growth and improving lifestyle may require higher quality consumption, which is likely to benefit branded consumer items in both discretionary and staples sectorsSocial welfare: government intention to improve the safety network whilst increasing household income is likely to drive demand for insurance products and public/private medical servicesElectric vehicles: the regulator will force automakers to increase production of their own electric vehicles. It may help generate substantial demand for upstream products, such as battery materials, including lithium and cobalt Industrial automation: higher labor costs are becoming a concern among manufacturers in the past few years. Factories will grow capex to automate their production lines using roboticsIT backbone infrastructure: the backbone infrastructure will need to be improved to facilitate increasing internet traffic, inducing good order flows in optical network and communications equipmentRisks on the horizonTo be sure, we do not view the world through rose-tinted glasses. The risks are manageable, in our opinion, but need to be monitored to avoid negative surprises. Our watchlist is as follows:Tightening liquidity will likely influence market sentiment next year. Any excessive liquidity withdrawal will likely challenge the above positive scenario.The potential retirement of long-serving PBO governor Zhou will create uncertainty. The new leadership team will need to earn market confidence.Interest rate hikes in the US can potentially dampen asset prices globally. 2017 showed the Federal Reserve’s ability to move without negative impact but this needs to continue in 2018.Rising geopolitical risk in North Korea and Middle East is a semi-permanent uncertainty that one must monitorLast but certainly not least, the US tax cut on corporate earnings can potentially cause outflows from emerging markets. Both capital repatriation and shifting expansion plans by US firms need to be monitored.We believe these risks are low probably events. We are comforted by the track record of both the Federal Reserve and the Chinese authorities to manage their liquidity withdrawals prudently. China will tighten liquidity if and only if macro-economic growth is strong enough to absorb the impact. Similarly, the Federal Reserve has given us no reason to doubt their methodical and data dependent approach. Importantly, should a global market correction occur, we believe Chinese A-shares are the most insulated asset class among global equity markets. Regards, David

Dec 19, 2017

In the same month that US residents were busy celebrating Thanksgiving and preparing their shopping lists for Black Friday, Chinese online spenders created another sales record in the annual November 11 consumer festival, known as Singles Day in China. The total gross merchandise volume (GMV) on Alibaba’s platform reached RMB 100 billion in the first 3 hours, and eventually became RMB 168 billion (or ~USD 25.3 billion) by the end of the day. The GMV is 3 times bigger than the combined sales of Black Friday and Cyber Monday in the US. A total of 812 million orders were generated in 24 hours, which equates to 9,400 orders per second. With the assistance of big data in facilitating faster delivery from closer warehouses and stores, the first order arrived at the customer’s door 12 minutes after purchase! Interestingly, 90% of payments went through mobile phone, compared to 41% just 3 years ago. It shows that mobile payment systems are getting more sophisticated rapidly in China and are way ahead of the West, where only 30% of shoppers used mobile payment during Black Friday in the US.Instead of simply looking at this as another consumption record, we believe this phenomenal event has a few implications to investors:China’s consumption story is real and remains strong despite a macro economy slowdown. Since everyone is buying from their savings at the moment, the industry outlook will be even brighter as consumer finance begins to pick up.Domestic consumption is capable of taking over from net exports and investment in driving economic growth, with consumption accounting for 64.5 percent of the headline growth or 4.4 percentage points in the first 9 months this year.There are innovative companies in non-consumer industries such as logistics, financial services and technology that are accelerating their development in order to cater for the increasing demand of Chinese consumers. Without the support of a reliable ecosystem, it is hard to accommodate the vast orders coming in and to ensure on-time delivery.China is already the world's largest e-commerce market and the share of online shopping that makes up all consumer spending grows every year. BCG forecasts online spending will rise by 20 percent annually to USD 1.6 trillion by 2020, compared with ~6 percent growth for brick-and-motor retail sales.For investors, the most direct exposure to this trend could be buying companies that operate online retailers/platforms and/or provide related infrastructure services. But the danger is that these companies are well known and a lot of the potential is already priced in. Strategies focused on consumption or new economy sectors may provide an alternative and more diversified way to benefit from this long-term trend. At Premia, we launched precisely such a strategy with 3173 HK. You can read about our approach here, or review the product details here.Beyond China, there are also some newly listed ETFs that offer an opportunity to express a pessimistic view on offline retailers by outright short-selling them or going long online retail while short-selling traditional retail.On a more personal front, you may be wondering if I contributed to the record sales of Singles Day this time around? In fact, I just bought a new electric scooter for USD 290 for my short-distance travel. Since I’m still waiting for it to arrive, guess there’s always room for further improvement in operations.Source: Bloomberg, Boston Consulting Group, Nov 2017

Nov 30, 2017

Premia 图说

朱荣熙

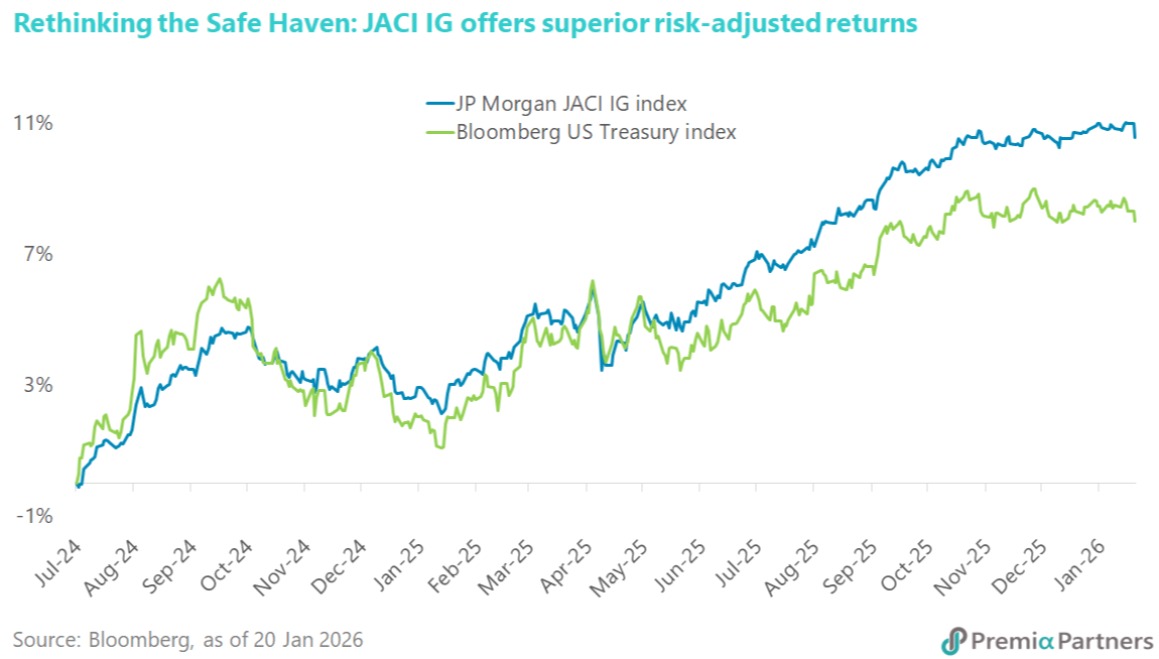

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026