주요 인사이트 & 웨비나

Further to the insight piece on “Taiwan: The Quiet World-Beater” shared by our Senior Advisor Say Boon Lim, in this article we share more about our new ETF Premia FTSE TWSE Taiwan 50 ETF, which covers the 50 largest flagship companies in Taiwan by market capitalization. The strategy aims to capture the strong market performance from the robust growth in demand for semiconductors and the broader economic growth activities in Taiwan in the coming years. It is designed as a low-cost, tax efficient access tool, with versatility of having both HKD (distributing) and USD (accumulating) unit classes.

Oct 09, 2024

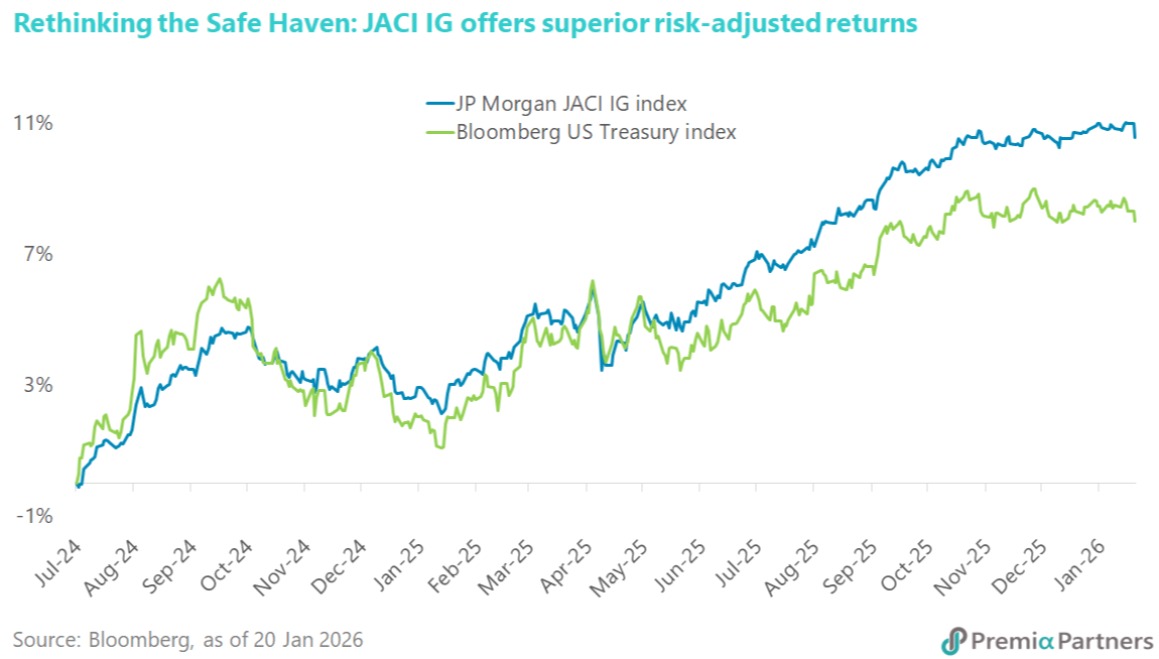

As the US Fed rate cut gets imminent, the liquid Asia credit market also is set to benefit from a number of strong tailwinds. In addition to favourable macroeconomic fundamentals, the heterogenous region also offers benefits of broad geographic diversification benefits and positive reinforcement from continued market liberalization and more investor friendly reforms. Within this space, Asian investment grade (IG) bonds also enter a favourable “Goldilocks” scenario in particular, represent a sweet spot that international allocators sometimes overlook, offering meaningfully higher yields, better credit ratings, and shorter duration than their peer IG cohorts from the US and Europe.

Sep 16, 2024

Given the inextricable links between energy-hungry Artificial Intelligence and renewables, energy storage and smart grids are a necessary “final mile solution” in the intensifying AI race. They provide the critical capability to store and dispatch huge quantities of uninterrupted renewable energy/power on demand without compromising emission reduction targets. In this regard, China is uniquely positioned to tackle the related challenges of AI and renewable energy with its rapid development and upgrades of energy storage systems and smart grids. In fact the country has long been studying intertwined strategic relationship between AI, technology and energy, and studiously incorporate such thinking into its Five Year Plans, and which are subsequently being rolled out as China’s East Data West Computing initiative. Further to our recent insight on China’s “power infrastructure” as the critical enabler for AI-development, in this article, we zoom in on China’s capabilities and investment opportunities in energy storage as the linchpin that holds the last mile solution, and matches renewable energy production with industrial demand in China’s journey to a high-tech, modern society.

Sep 11, 2024

In the midst of the AI-driven excitement surrounding major US tech giants, Taiwan has been quietly positioning itself as a significant player in the global technology sector. Over the past two years, Taiwan’s stock market has outperformed all major Asian markets and even surpassed the S&P 500 and Nasdaq 100 in returns. This success can largely be attributed to Taiwan's critical role in the semiconductor industry, which continues to drive its economic growth and investment appeal. In this article, our Senior Advisor Say Boon Lim discusses drivers supporting the unique, strategic moat Taiwan has built over the years, and why it will likely remain an attractive investment destination going forwards, on the expected continued robust growth in demand for semiconductors and its broader economic growth activities over coming years.

Sep 05, 2024

The time has come – Federal Reserve chair Jerome Powell finally signalled that rate cuts will likely start in Sep at Jackson Hole, though his remarks offered few clues as to how the Fed might proceed after its Sep gathering. On the surface, extending duration in US Treasuries appears to be a straightforward decision given the assumption that falling interest rates will lead to rising bond prices. However, it is not without risks and complexity as we are entering the rate cut cycle against very different backdrop from previous cycles. In this article, we discuss the intricacies of the upcoming rate cut trajectory, and why US Treasury Floating Rate Notes (FRNs) remains a relevant strategy for investors seeking diversification and stability as a result of the very much inverted yield curve, and market uncertainties in this journey.

Aug 28, 2024

Going into a July meeting of top party officials at China’s Third Plenum, held once every five years, first-quarter hopes of a 2024 recovery in China’s economy had given way to macro uncertainty, as strength in manufacturing and exports served for many to highlight just how weak domestic sentiment and consumption remain. In this article, Dr. Phillip Wool, Global Head of Research of Rayliant Global Advisors, digs into such challenges and potential paths forward for Beijing, including our thoughts on a Third Plenum meeting that didn’t yield any policy bombshells, but still offers clues as to where investors might focus as we enter the second half ready for bargain hunting.

Jul 30, 2024

While Artificial Intelligence Generated Content (AIGC) has been dominating media and market attention, the “next big thing” has been developing rapidly in the background in China, in the form of super-scale AI infrastructure. It involves, among other things, a national computing power network; data centre clusters from Guangdong to Inner Mongolia and from Gansu in the West to Anhui in the East; centres for the development/training of large language models; and abundant green energy integrated with massive energy storage facilities. What is rapidly emerging is a gigantic national network connecting smart grids, intelligent network routing and energy storage – one that has no parallel anywhere else in the world. The pay off will be lower cost execution of computing processes and high-end manufacturing/AI-based industrial automation. The current media focus has been on the speed of the microchip as the key factor in the AI race. The following insight details the elements of the AI-infrastructure that are likely to prove critical in the next phase of AI development.

Jun 19, 2024

China’s household consumption appears to have been massively underestimated in international comparisons, because of differences in data definitions and valuation methodologies. The two big areas of differences in international comparisons are: 1) Social transfers in kind, which could be worth some 6% of GDP; and 2) The value of housing services provided by owner-occupied homes, which could be worth another 5% of GDP. In this article, our Senior Advisor Say Boon Lim discusses why the criticisms of China’s growth model and "underconsumption" look flawed.

May 09, 2024

Despite mainland stocks putting up a solid Q1—the CSI 300 Index gained 3.1% for the quarter—and although macro fundamentals appeared as if they might be turning a corner at the start of 2024, bullish sentiment toward China equities had yet to materialize, with many questioning whether a first-quarter rebound would sustain. In the commentary below, Dr. Phillip Wool, Global Head of Research of Rayliant Global Advisors, delves into the details of China’s economy and market action during Q1, discussing how Beijing’s plan to nurture high-quality growth might translate to macro conditions and investors’ portfolios.

May 09, 2024

While investors would look at it as a period of crackdown on for profit tutoring businesses, since the “Double Reduction” policy (to reduce the pressures of homework and after-school tutoring) in 2021, young students indeed are able to spend more time on extracurricular activities that they enjoy. Given the size of addressable market, there has been a proliferation of various STEM (Science, Technology, Engineering, and Mathematics) learning, traditional culture and art-jamming activities in China, including many well-equipped new establishments fitted out with the latest digital technologies such as AI, 3D exhibitions and robotic guides, catering to various developmental needs and interests of children who now have more free time at hand they can deploy for more fun activities. Take the Guangdong province for example, there are 150 public libraries, 144 cultural centers, 352 museums, and 141 art museums built as of 2023 – and many of these are free of charge or charge very affordable fees available for both locals and visitors. In this article we share some of the popular ones that you may find of interest for your next trip to the region.

Mar 26, 2024

토픽별

주간 차트

Alex Chu

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026