주요 인사이트 & 웨비나

With many of the global leading high tech manufacturing players, the Taiwan stock market sits at the confluence of the global tech super cycle, robust earnings growth and modest valuations, and is home to many global leading Asian technology players. The fundamental tailwinds that drove the Taiwanese stock market’s outperformance from 4Q25 are likely to continue carrying the rally in 2026. Indeed, the Taiwan market appears to be in the early stages of its outperformance cycle. In this article, our Senior Advisor Say Boon Lim explores why in addition to TSMC, the blue chip cohort from Taiwan offers global investors a unique diversification opportunity, providing exposure to technology super cycle beyond US big tech names, complemented by its attractive valuations and low correlations with other major asset classes.

Feb 02, 2026

Analysts including JP Morgan, Goldman Sachs, Morgan Stanley, HSBC, and Standard Chartered are generally bullish on Emerging Markets (EM) for 2026, citing dollar weakness, AI growth, and affordable valuations. Within EM, EM ASEAN is an under-appreciated sweet spot that blends value, yield and structural upsides. In this article, our Senior Advisor Say Boon Lim discusses how the region transitions towards more domestically-driven growth, with macro tailwinds from significant foreign direct investments, public infrastructure spending, and robust exports fuelled by AI demand and global supply chain dynamics.

Jan 19, 2026

As markets enter 2026, the need for diversification has gained an urgency not seen since possibly at the peak of the Nasdaq Bubble in year 2000. Both US stocks and corporate credits are priced for perfection in an economy that has been held up by stretched fiscal and monetary stimulus. The sales pitch of “American exceptionalism” may be wearing thin. US Big Tech is overpriced and may have overinvested in AI. Meanwhile, the labour and consumer markets are weakening even while inflation remains stubborn. The long-end of the Treasury yield curve has started ignoring rate cuts – a sign of concern about the sustainability of US government debt. In this article, our Senior Advisor Say Boon Lim discusses the urgency of diversification away from US-overpriced assets, while China and emerging ASEAN markets present compelling complementary attributes for diversified multi-asset portfolios.

Jan 13, 2026

China approaches 2026 on a firmer economic and market footing, supported by clearer policy direction and a maturing innovation ecosystem. While growth may ease slightly from recent levels, structural themes—ranging from advanced manufacturing upgrades to measures addressing excess capacity—are set to shape the early phase of the 15th Five-Year Plan. Domestic investors are gradually shifting from deposits toward higher-return financial assets, adding resilience to onshore markets. In fixed income, moderating yields and strengthening demand for RMB-denominated assets create a more constructive backdrop for China government bonds. In this article, our Partner & Co-CIO David Lai discusses how these developments foster a more stable and attractive investment landscape, offering compelling opportunities to express China exposure across both equities and fixed income.

Jan 13, 2026

AI was the common theme for growth across markets last year. S&P500 and Nasdaq delivered +17% and 21% respectively in USD terms for FY2025, while China broad market (CSI300) rallied 21%, and China tech outperformed with +46%, Asia tech was up +45% and Taiwan stock market gained +40%. Going into 2026, few would dispute drivers for stock market performance would continue to be innovation-led opportunities. In this article, we discuss tailwinds from the hardcore tech especially AI infrastructure, semiconductor, robotics, and biotechnology, where technological breakthroughs, accelerated commercialization and improved earnings growth and profitability support further re-rating actions ahead. This is where our Premia China STAR50 ETF and Premia China New Economy ETF focus on, and would serve as efficient and optimized vehicles to provide direct access to the leading beneficiaries that are poised to define China's economic trajectory in 2026.

Jan 13, 2026

Following a historic breakout in 2025, the Premia Vietnam ETF rallied a stunning 73% (total return in USD NAV) in 2025, while the broad market also rallied 39%. The market is now transitioning from recovery in sentiment to a phase of progressive policy execution, including the "Doi Moi 2.0" reforms (Resolution 68). These reforms offer unprecedented policy support for the private sector. And the mandate to nurture 20 globally competitive large private firms provide strong cases for revaluation opportunities for large cap leaders. In this article, we will explore why Vietnam remains a compelling market in 2026 amidst imminent FTSE Emerging Market upgrade. Our Premia Vietnam ETF—with its focus on private sector champions and Small-Mid caps—is distinctively positioned to capture the specific beneficiaries of these structural shifts.

Jan 13, 2026

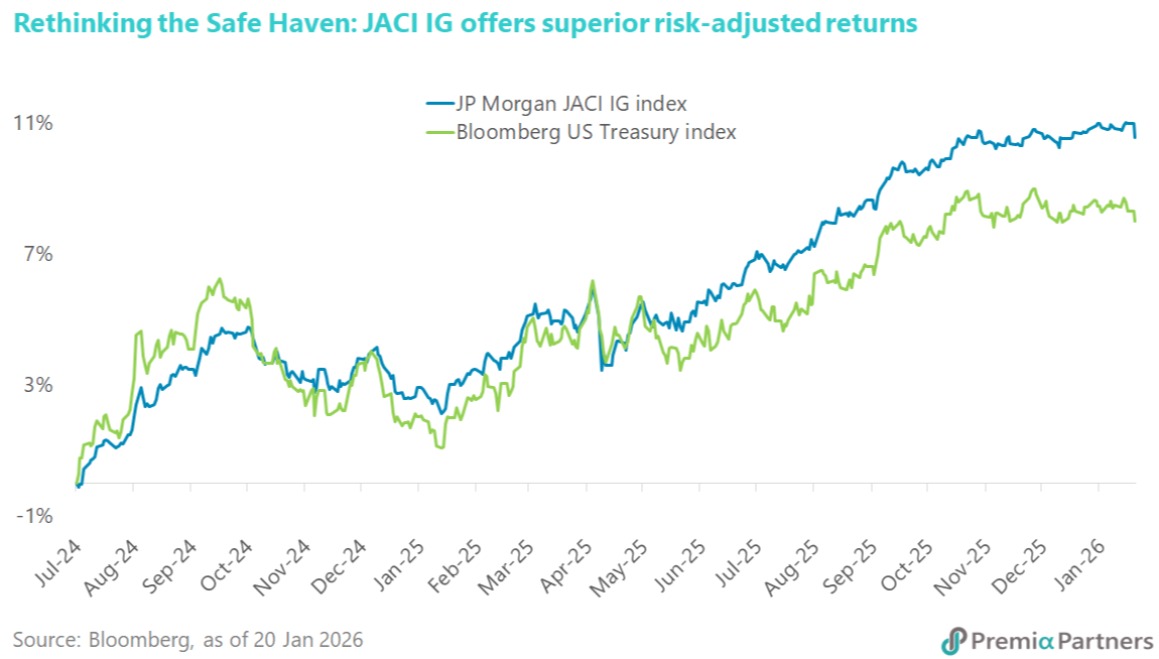

The Fed shifted from hiking to easing as it appeared to tolerate 3% inflation as the new target and prioritized labour market conditions. The 10-year Treasury yield remained above 4% amid concerns over deteriorating US fiscal health and elevated inflation. Meanwhile, markets grew increasingly alert to vulnerabilities in US private credit, with rapid growth in AI-related investments and high margin debt cited as potential pressure points. Meanwhile, Asia’s USD credit market closed out the year on a high note, with tight spreads and strong returns driven by solid fundamentals and technicals, while Saudi government sukuk also delivered modest gains last year. In this article, we discuss how Asia ex-Japan investment grade bonds and Saudi government sukuk continue to stand out as compelling alternatives, as the trend toward diversifying away from the US is likely to persist in 2026.

Jan 13, 2026

The risk profiles of Emerging Market (EM) investment grade (IG) vs their developed market (DM) peers are converging. In fact, amidst spending/borrowing excesses in the DM, rising long-term government bond yields, and recent cyclical lows in US corporate credit spreads, volatility for DM bonds has risen substantially since 2020, prompting the expression the “EM’ification of DM debt”. Meanwhile EM IG bonds have been relatively stable, and the search by asset allocators for alternatives to DM bonds will likely continue the pivot to EM IG bonds. Beneath the surface of the short-term volatilities and possibly a longer-term repricing of multiple assets, Asian IG bonds and Saudi government sukuks may just be the sweet spots for attractive, uncorrelated and resilient returns regardless which side one is at on the debasement debate. In this article, our Senior Advisor Say Boon Lim discusses how the asset allocators are increasingly turning to EM IG bonds as compelling alternatives to DM bonds, for which our Premia JP Morgan Asia Credit Investment Grade USD Bond ETF (3411/9411 HK) and Premia BOCHK Saudi Arabia Government Sukuk ETF (3478/ 9478 HK) would be useful allocation tools in this pivot.

Nov 10, 2025

China's biopharmaceutical industry is undergoing a landmark transformation, emerging from a period of profound recalibration to establish itself as a global powerhouse. Propelled by its talent, patient access, cost-efficient infrastructure, and catalysed by comprehensive government policies aimed at supporting the innovative drug value chain, the sector is experiencing a broad-based resurgence, with results beginning to show in earnings and valuations in the first half of the year. The journey, however, is just beginning, fueled by the impending global patent cliff and its strong value proposition: delivering high-quality, innovative medicines at an accelerated pace. This capability ensures China's biopharma sector an indispensable player in the global market, even in the face of possible geopolitical headwinds. In this article, we discuss about the leading innovators in the homegrown biotech landscape—companies well-represented in our Premia China New Economy ETF (3173/9173 HK) and Premia China STAR50 ETF (3151/9151/83151 HK), which have outperformed multiple benchmarks year-to-date and will continue to drive alpha returns for global investors, propelled by a revaluation trend driven by domestic policy tailwinds, strong external partnerships and a rising market value.

Oct 03, 2025

Vietnam stands out as Asia’s best-performing equity market in 2025, fueled by earnings recovery, policy support, and surging public investment. More importantly, Resolution 68 marks the country’s boldest reform agenda since Doi Moi—streamlining bureaucracy, empowering the private sector, and deepening capital markets—creating structural upside beyond cyclical drivers. With infrastructure projects worth over 10% of GDP, robust FDI inflows, and the potential MSCI/FTSE upgrade unlocking sizable foreign flows, Vietnam offers a rare blend of near-term catalysts and long-term growth. In this article, our Partner & Co-CIO David Lai discusses how Premia Vietnam ETF offers investors a diversified, transparent, and cost-effective vehicle that has consistently outperformed active peers—positioning portfolios to capture one of the most compelling reform-driven growth stories in emerging Asia.

Sep 12, 2025

토픽별

주간 차트

Alex Chu

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026