精选观点 & Webinar

The US Federal Reserve has signalled the imminent start of the transition from the Great Stimulus of 2020-2021 to a period with new uncertainties. The Fed’s suggested pace of tapering quantitative easing was at the high end of expectations. In this article our Senior Advisor Say Boon Lim discusses his thoughts on what to expect regarding US inflation rate and 10Y UST yield, and why we need to brace for more challenging US equity and bond markets with lower return and higher risk coming up on the horizon.

Oct 05, 2021

The upward momentum of US equities has slowed considerably over the past 16 months, from the explosive initial rebound in late March last year. Our sense is that we would either see small gains in coming months or indeed a correction in the face of the likely peaks in economic growth, earnings growth, and policy stimulus. In this article our Senior Advisor Say Boon Lim discusses why investors in US equities may have to lower their returns expectations for 2H21 in the face of what some are calling the “triple peaks”.

Aug 18, 2021

China market saw a material correction due to the regulatory crackdown in the offshore tech and education space. The panic sentiment led to indiscriminative unwinding of Chinese stocks by foreign investors, pushing the HK-listed tech names and the US-listed China ADRs into a bear market technically. Although the regulatory risks remain high in near-term, investors seem getting a stronger hint about the policy direction. The glory days when China tech can be simplistically covered by just the offshore tech giants is gone, and there is increasing need for more granular understanding of the related policy headwinds and tailwinds. In this article our Partner & Co-CIO David Lai shares the thesis behind our Premia China STAR50 ETF, and how this timely launch adds value through its diversified exposure of the leading innovative and strategically important hi-tech companies focusing on innovation and hardcore technology.

Aug 05, 2021

Due to popular demand, we have recorded again the STAR50 webinar for those of you who missed it last week or would like a recap of the discussion. In the webinar we shared about the genesis and strategic focus of the STAR Board, the index methodology and key features of the STAR 50 index, and also some interesting examples of emerging innovation leaders across including semiconductors, cloud, AI, 5G, biotech and also new materials and new energy. With its lower correlation with mainstream CSI300, China ADRs as well as very low correlation with S&P500 and Nasdaq, we hope it would be a good tool to serve your diversification need as you reconfigure your China/ EM construct for the new normal. [WATCH NOW]

Aug 04, 2021

Recently we wrote about how investors can navigate “Mr. Market’s manic-depressive mood swings”, cautioning that those swings are likely to get shorter and more frequent. Indeed, Mr. Market may already be getting grumpy again. And it is not quite because things are going badly. It will more likely be because he has gotten ahead of himself in terms of expectations. In this article our Senior Advisor Say Boon Lim shared his thoughts on why a correction is due and it’s important to watch the divergences - as the high growth with low inflation narrative is wearing thin and the US economy may be losing its ability to surprise on the upside.

Jul 22, 2021

Navigating Mr. Market’s Mood Swings Warren Buffett – channeling his teacher Benjamin Graham – famously said: “Mr. Market is kind of a drunken psycho. Some days he gets very enthused, some days he gets very depressed.” In recent times, the market has looked a lot more like the “drunken psycho” of Warren Buffett’s characterisation than usual. In this article our Senior Advisor Say Boon Lim shares his thoughts on how we would navigate through the market swings under signals from rate movements and expectations, economic recovery, covid control and vaccination roll outs, and in the process, the divide between the “vaxed” and the “vaxed-nots”.

Jul 15, 2021

We recently completed the annual rebalancing exercise for the two China A shares and Asia Innovative Technology ETFs. In this article our Portfolio Manager Alex and Partner & Co-CIO David will share more about the changes and portfolio characteristics post-rebalancing, which further align with strategic focuses of China’s 14th Five Year Plan, and recalibrate for opportunities in the new normal as COVID recovery in China and Asia enters the next stage.

Jun 24, 2021

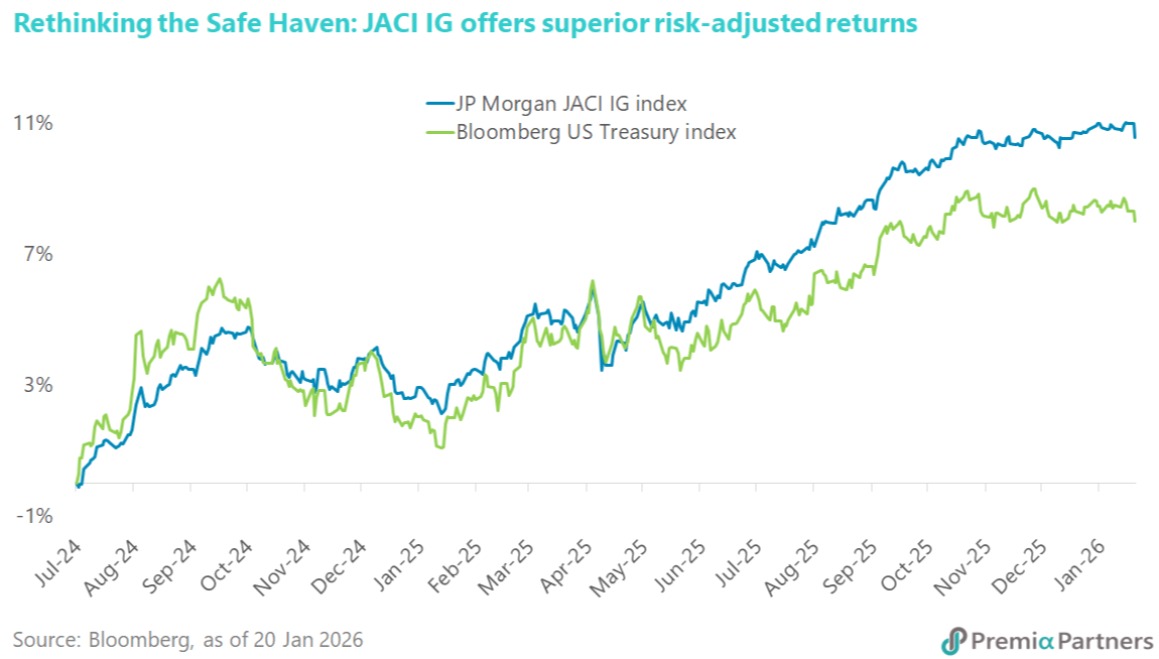

Amidst the high risk of holding Developed Market government bonds and credits in an environment of rising inflation and historically low spreads, a frequent lament among institutions and large family offices is “but our mandate requires us to hold bonds.”

Jun 17, 2021

We are delighted to invite Edmund Ng, Founder & CIO of Eastfort Asset Management to share with us the nuances of investing in the China bond markets, and the tailwinds, headwinds and sweet spots for international investors. Edmund brings very deep understand of the China bond markets as a veteran practitioner, and was the Head of the Direct Investment Division of Hong Kong Monetary Authority (HKMA), which under his leadership started to diversify part of its large reserves into other asset classes including CNY bonds. [WATCH NOW]

Jun 16, 2021

The inflation threat is now clear and present. And while equities may tolerate rising US inflation for a while longer, the Developed Market bond markets are highly vulnerable.

May 26, 2021

Premia 图说

朱荣熙

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026