精选观点 & Webinar

It’s been a month since we launched our ETFs and we’ve been asked by a few clients to walk through a quick synopsis of A-shares vs rest of world, as well as the various options available within A-shares. I thought it would be easiest to cover these topics through a valuation and mean reversion lens, as that seems to be the angle missing from many of the comments I see about continued performance upward.Valuations overallNick Ferres, Vantage Point’s CIO, covers the risks quite well here, so I’ll start with a summary of his points. Technology stocks have seen positive price movement justified by their earnings so far, but the latest moves up have been parabolic and likely entering the last phase of the bull market before a potentially aggressive correction. Speculative excess can be seen elsewhere as well, from bitcoin to art auctions. Here’s my very simple monitor for the same thing: Source: Bloomberg, as of 21 November 2017 Forward P/E ratios are higher than their 10yr averages in every major DM and EM market except Japan. The premium ranges from 12% to 24%. The highest is in China offshore stocks while the lowest, curiously enough, is in China A-shares. Similarly, on a Price to Sales (P/S) basis, all markets are higher than their 10yr averages. EM has the lowest premiums (again, with China offshore stocks being the exception), but that is likely driven by the tech rally, which you can see all the way on the right. The tech sector has a P/S premium of ~60-70%! Tech sector earnings growth justifies some of the premium, but the valuation levels today suggest a recovery not far on the horizon. A-shares vs rest of world In a world of high valuations across the board, a long-only investor needs to do 2 things to protect their portfolio: 1) identify the catalyst likely to cause the rally to sputter, and 2) identify a market that has lagged (and is therefore cheap) and has relatively low correlations with the rest of the world. The charts above give us a hint for the latter, but let me quickly share my thoughts on potential catalysts. In my mind, there are 2 catalysts big enough for investors to stand up and notice and geopolitics is not one of them. Short of outright war, investors have from time and time again shown a willingness to ignore geopolitical risk. The bigger issues in my mind are a failure of US Congress to pass tax reform and disappointing news from the FANGs, BATs or any of the other major tech firms. US tax reform is far from a done thing and as the debates on travel bans and healthcare reform have shown, a desire to act is far from an ability to act. A failure on this front would cement a mindset that President Trump cannot accomplish much of anything and that the lofty valuations and confidence underpinning current market levels may not be warranted. On the tech side of things, I don’t think it would take much for investors to take profit. Earnings growth expectations are quite high and even a “just OK” number might be an opportunity for some to exit. The looming possibility of greater regulation is also not out of the question. If either of these events occur, where can we seek refuge? You guessed it! A-shares are not only relatively cheap, but are also under-owned by investors, uncorrelated with the rest of global markets and have a large wall of money (both foreign and domestic) coming their way. From a fundamental asset allocation point of view, A-shares volatility has trended down materially in recent years, the RMB is stable, IPOs are decreasing, and the economy is quite robust. All in all, a good story that can be summed up in 6 quick charts. Source: Shanghai & Shenzhen Exchanges, Bloomberg, as of 21 November 2017 A-shares with nuance If you agree with the above logic and are thinking of adding A-shares to your portfolio (or already have them), then the next question is deciding how to obtain the exposure. We’ve already spoken about the issues with existing beta options for mainstream exposures here and the lack of new economy options here. Today, I’d like to dig into style and sector performance to show why a simple mkt-cap construct is not your best bet. From a style point of view, the 2 most common strategies globally are value and small size. In developed markets, value has consistently outperformed since the ‘70s, but has suffered vs growth over the last few years. Small caps have not had such issues, showing consistent outperformance across pretty much every period. You can see the details below: Source: Bloomberg, as of 21 November 2017 What do these charts look like in A-shares? Given their uncorrelated nature, we see the exact opposite pattern over the last few years! Value has consistently outperformed but small caps have experienced a massive correction over the last 1 year. Coming off non-sensical highs in 2015, small caps have re-rated massively vs large caps, underperforming by ~12% annualized since the peak of 2015. Source: Bloomberg, as of 21 November 2017 Some investors might view this as proof that one should invest in China mega-caps only and leave the rest alone, but we take a different view. Coming back to valuations, it is evident that 2015 small cap multiples were unrealistic and have simply corrected to their long-run average (in fact, below it if you include the peaks as the chart below does). In contrast, large caps are flirting with their 2011 and 2015 valuation peaks. Source: Bloomberg, as of 21 November 2017 Size on its own can be quite volatile and we suggest that a singular focus on the size factor be handled with caution. As a result, we decided to take a multi-factor approach for our Bedrock Economy and New Economy ETFs. 2803 HK (Bedrock) provides a value, balance sheet health, low vol and low size bias. While this has resulted in underperformance so far in 2017, the combination of value and size exposure should generate substantial excess return going forward. 3173 HK (New Economy) is a services sector play – focused on consumer discretionary, technology and healthcare sectors. Its diversified sector exposure and balance sheet health, profitability and R&D bias has resulted in material outperformance vs Chinext so far this year, but significant size bias has detracted from performance relative to the large cap benchmarks. Source: Bloomberg, as of 30 September 2017 To wrap up, A-shares are a relatively cheap alternative to global markets’ increasingly stretched valuations. The challenge is what type of China exposure investors want to have in this market. Mainly large cap banks and some industrials and real estate? Then FTSE A50 or CSI 300 are the way to go. For a broader but still traditional exposure, 2803 HK lowers financials to more reasonable levels, adds consumer discretionary and prioritizes value and size factors to deliver excess return. Or, for those who want to focus on new vs traditional economy sectors, 3173 HK offers close to 0 financials, real estate and energy stocks and instead targets consumer discretionary, technology and healthcare stocks while prioritizing size and balance sheet health factors.

Nov 28, 2017

创新逐渐成为经济增长的关键要素——"中国山寨"成功转型为"中国制造",而亚洲地区的整体趋势亦如是。然而,目前为止,市场上仍缺乏简单有效的方法投资亚洲创新机遇。本篇文章,我们将讨论亚洲创新发展的现况即行业影响,并介绍Premia与FactSet合作推出的亚洲创新科技策略,亚洲创新科技指数为投资者系统化、精确地捕捉亚洲创新科技大趋势——数位转型、生物科技与医疗创新、人工智能与机械自动化。

Oct 18, 2017

A-shares are a deeper, broader, cheaper and less correlated market than offshore Chinese equities. Investors should review their portfolios given the benefits of A-shares to overall asset allocation.

Sep 28, 2017

Size works in A-shares, but for this article we'll put that aside and focus on implementation feasibility.

Aug 01, 2017

Without any screening or selection, solely investing in all SOEs or the largest market cap SOEs may not be optimal strategies. What is important for investors is how to capture the current contributors and engines for future growth of China economy regardless whether the underlying stocks are SOEs or non-SOEs.

Jul 04, 2017

A quick review of what MSCI did and didn't do, its impact, why it matters and how investors should approach China going forward.

Jun 23, 2017

Our advisor, Dr. Jason Hsu, recently did a podcast with Meb Faber (co-founder and CIO of Cambria Investment Management) on China opportunities, investors' preference for complexity over simplicity, and key takeaways for investors implementing smart beta strategies in China.

Jun 08, 2017

This morning Bloomberg ran a story about LeEco, a Chinese technology conglomerate that has been growing rapidly until recently.

May 24, 2017

Are all smart beta products smart? This is a question I've asked a few times over the last few years but always got a "nuanced" answer depending on the product being marketed.

May 15, 2017

Premia 图说

朱荣熙

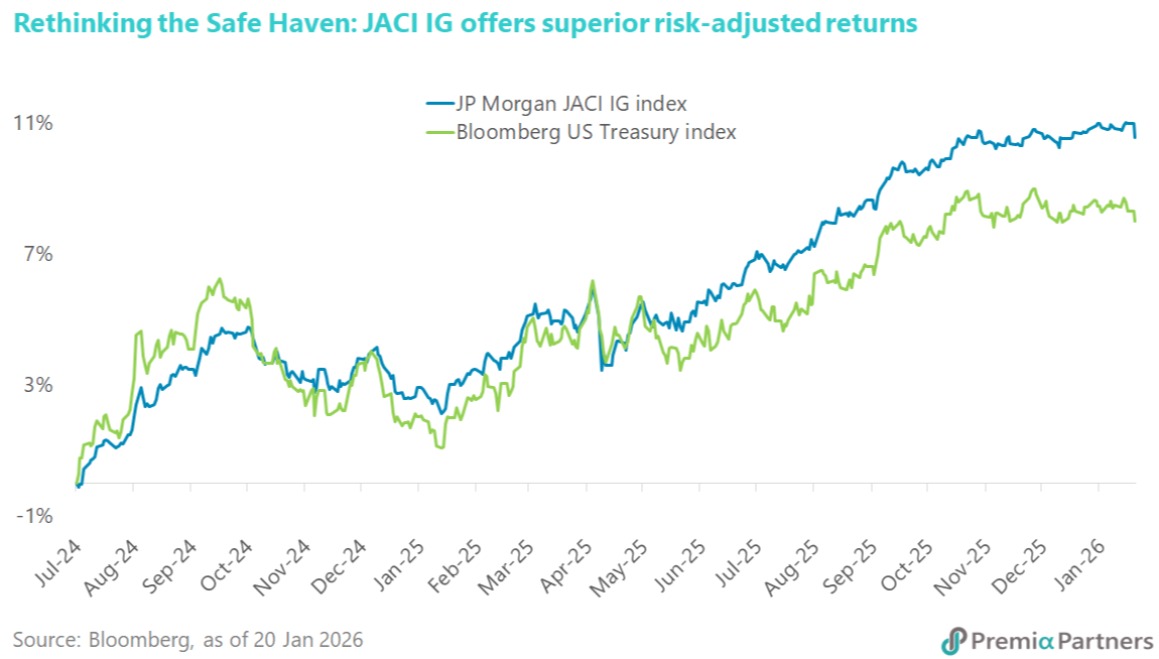

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026