精选观点 & Webinar

If we agree China may offer outperformance in 2023, then the next step is to figure out the right positioning to capture the alphas. Investors are now at a crossroad to decide whether China tech is still investible. On one hand, the Internet platforms, used to be the market leaders, may no longer be the high-growth candidates in future as shown by the recent sluggish financial results. On the other hand, technological advancement remains one of the government’s key agendas that should help support the sector. In this article, we would like to share how to identify the “right” tech exposure to capture the opportunities in China market.

Dec 13, 2022

2023 will likely present investors with a stark economic divergence – between a West in recession and an East where growth will be boosted by recovery in China. ASEAN-5, which already enjoyed its own reopening rebound in 2022, will likely ride the tailwinds of China’s turn at a reopening recovery in the coming year. In this article, we would discuss how ASEAN-5 will likely continue to be in a sweet spot in 2023, offering some of the highest economic growth rates with relatively moderate inflation.

Dec 12, 2022

With the more positive sentiments from the G20 meetings and market expectations of earlier pivot for China’s zero covid policy, growth including technology strategies also started to see varying degree of positive swings and rallies along more sustained upward trajectory. Contrary to the US tech peers, Asia innovative technology and metaverse leaders having started massive corrections earlier also appear to be first in first out and are emerging to resume growth on the back of multiple tailwinds. As investors revisit the investment case for the metaverse and innovative technology space, how would we configure for the opportunities in Asia and fill the gaps that the US oriented global tech strategies typically miss? In this video, we would recap the construct of Premia Asia Innovative Technology & Metaverse Theme ETF (3181/ 9181 HK), which is designed to capture opportunities in Digital transformation, Robotics & Automation, Innovative Green Technology as well as Metaverse which have been transforming the enterprise and consumer space (including with virtual influencers). The strategy was first introduced in 2018, and given the sector and geographic diversification has been outperforming other global, US and China focused peers in 2-year, 3-year and 5-year periods. It was also able to hold at -7% last year after the strong rally of 40% and 60% in 2019 and 2020 outperforming in both bull and bear market cycles. For investors looking for strategic growth opportunities in this space, this would be a good, balanced tool for implementation.

Dec 09, 2022

It was challenging for global investors to find a market that could offer a positive return in 2022. China market can’t escape from the selloff, with H-shares, A-shares and ADRs down by 20% to 29% in dollar return in the first eleven months of the year. The market turnover was shrinking whilst foreign investors were net selling. Internally, the frequent COVID-lockdowns, a property market slump, an ongoing Internet scrutiny, and the deteriorating bilateral relationship between China and the US all contributed to the bearish sentiment in Chinese equities. Externally, the Ukraine-Russia war, high inflationary pressure, an accelerated rate hike cycle, and strengthening dollar have further weakened investors’ confidence towards risky assets.

Dec 06, 2022

In a discordant world, there are no overarching investment themes. The different parts of the world are marching to different drums – their economies and markets are driven by different cycles, different prior policy choices and factors beyond their control. The US economy and market are paying back for the extreme policy stimulus of 2020-2021. Europeans are paying back for the same, with the added pain of a war outside their control. Japan is battling a chronic ailment – extreme debt – made acute by sharply higher cost of US funds. China is at the bottom of its policy cycle, at the beginning of a path out of COVID health controls.

Dec 05, 2022

After finishing Q2 as the only emerging market in positive territory, the effects of zero-COVID policy, a continued slump in the property market, and weakening global demand pushed Chinese stocks to the bottom of the EM index in Q3. The CSI 300 Index dropped by -14.3% over the three months from July to September 2022. Below, we offer deeper insights into third-quarter performance—including some bright spots among state-owned enterprises and technology with a policy tailwind—along with our thinking on October’s National Congress and what the rest of the year might have in store.

Oct 31, 2022

Unlike in developed markets, healthcare is actually a growing “new economy” sector in China that offers tremendous opportunities for global investors. As the Chinese economy evolves, the sector also enjoys fundamental tailwinds such as rising demand for healthcare and wellness services as living standards improve, and an aging population with low birth rates. Meanwhile being a growth sector with public interest concerns that is also popular among retail investors, the healthcare sector also experiences volatility swings and regulation tailwinds from time to time such that taking a diversified approach with consideration for fundamentals may be more optimal. In this article, we would take a closer look at the various underlying sub-segments, review their characteristics and also highlight some of the leading A-share companies driving the growth opportunities in their respective space.

Sep 20, 2022

If the KOLs (key opinion leaders) have stormed the world with livestreaming and short videos globally in recent years, the metaverse is bringing on a new cohort of KOLs across Asia – virtual influencers. In fact, Asia is already seeing very rapid growth of virtual influencers, given the high internet penetration, digital economy and demographic tailwinds across the region. From Korea, China, Japan to Singapore, Malaysia and Thailand, brands and marketers across industries are increasingly ready to adopt and experiment, especially those targeting young consumers. In fact according to Jing Daily estimates, of the 80% of Chinese netizens following online celebrities, over 60% follow virtual idols and over half spending at least RMB500 a month on related purchases. Virtual KOLs also are said to often have interaction rates three times higher than their real counterparts. In this article, we shall share more about this coming of age of virtual influencers in Asia, with a deeper dive into the observations in Korea where the virtual influencers are bringing important new elements to the K-pop industry.

Sep 09, 2022

Sichuan has a very real climate change issue to manage this year. After extreme heatwave and drought causing power rationing for industrial users for two weeks, the province is now quickly re-gearing for Level IV flood emergency alert. While most factories are able to resume production now, should we be concerned especially with memories from the power crunch actions last year? What would be the impacts and ripple effects we should pay attention to? In this article we reviewed the background triggering the Sichuan situation, and why we believe the power rationing events are more pre-emptive in nature and energy security is very carefully managed in the planned economy of China.

Aug 31, 2022

Global markets have been subject to higher volatility so far in 2022 amid escalating inflation and recession risks. The US rate hike cycle has added further pressure to the dollar return of most foreign-currency-denominated assets due to the strengthening dollar. In this article, we describe the genesis behind the recent addition of USD hedged unit class to our Premia China Treasury and Policy Bank Bond Long Duration ETF (9177.HK), which is the first among peers to offer USD hedging feature in Asia. For investors that are mindful of mark to market risk amid continued US interest rate hikes, as well asset owners with long duration allocation needs, the Premia China Treasury and Policy Bank Bond Long Duration ETF is a unique tool that provides access to the long duration Chinese government and policy bank bonds with strong A1 sovereign bond rating, competitive yield of over 3%, stable yield volatility and now with the USD hedged unit class, additional optionality to capture the steady yield of China sovereign bonds whilst minimizing exchange rate risks for RMB.

Aug 18, 2022

Premia 图说

朱荣熙

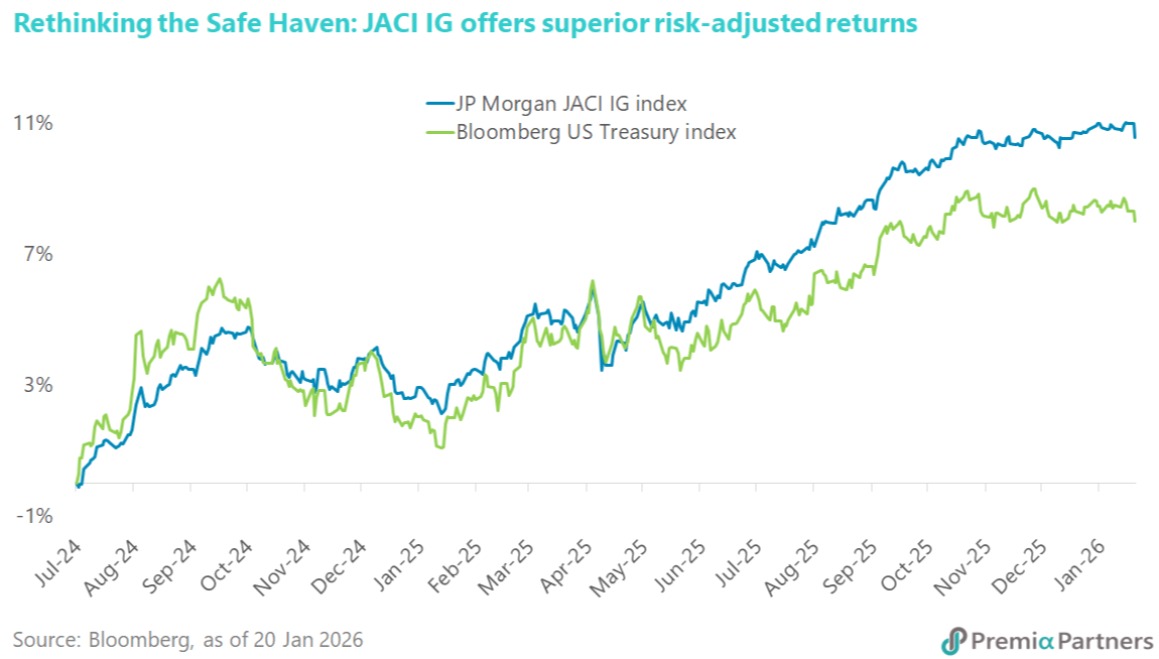

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026