精選觀點 & Webinar

With the CSI300 up ~25% YTD, many clients are worried that the market has fully priced in the MSCI inclusion. We review 5 flawed assumptions and explain why the rally is just the start of a long-term trend.

Mar 26, 2019

As China markets reacted to expansionary policy news, familiar criticism of China’s debt and leverage concerns has begun to emerge from global investors. Separating myths from reality, our advisor Say Boon Lim shares his thoughts on the 5 biggest myths about China’s economy.

Mar 13, 2019

So far in 2019, markets have moved positively and our worst fears from Q4 remain unfounded. However, investors should not be complacent and interpret this period of good news as predictive of the rest of 2019. Markets are likely to again fear the future. In this week’s post, our advisor Say Boon Lim shares his thoughts about the current period of benign market activity.

Feb 18, 2019

As we pass the 6-month anniversary of our latest ETFs, we review their performance since launch, the underlying story behind the exposures and the potential for returns going forward.

Feb 13, 2019

今年,我們正在進入市場的一個交叉路口,許多週期即將告一段落。本文是林哲文先生作為我司資深指導顧問的首篇撰文。林先生在下文中提出了他在當下錯綜複雜的經濟、市場和貨幣週期中對於資產配置的見解。以此配置建議為指引,我們在股票、固定收益、大宗商品和貨幣方面分享了投資者在 2019年可以採用ETF為實踐工具的投資策略。

Jan 25, 2019

Emerging markets seem to be one of the top picks among both sell-side strategies and well-known investors in 2019. We would like to examine if their views are valid and understand better about the reasons behind. To make it into an actionable advice, we also share our thought why emerging ASEAN maybe the crème de la crème and update our readers on the performance of Premia Dow Jones Emerging ASEAN Titans 100 ETF.

Jan 14, 2019

As we wrap up 2018, it’s hard not to reflect on a -25% year in A-shares. As investors, however, we have to look forward and ask ourselves – what’s in store for 2019? Will the trade war result in continued downward momentum? Or will policy accommodation and an improved trade environment result in a massive upside reversal? Looking back 10 years to the global financial crisis, we examine a potential path forward for A-shares in 2019.

Dec 17, 2018

Below is a quick summary of what you need to know regarding this weekend’s G20 Xi-Trump meeting and our thoughts on impact for Asian and Chinese equities.

Dec 03, 2018

For the past 5 years, the surest trade in finance was to bet on US technology stocks and watch market caps double and portfolio returns roll in. However, the last few months have shaken that confidence and now many investors are asking what’s next, given the diminishing growth picture globally. Asian companies focused on innovation offer an interesting opportunity in this regard, especially considering the correction so far and their potential going forward. Though many VC and tech investors have already made the shift to Asia, that move is yet to occur in public equity markets. We believe our Premia Factset Asia Innovative Technology Index, and its corresponding ETF, 3173 HK, should be in every global and tech investors toolkit.

Nov 27, 2018

On the 1 year anniversary of our China A smart beta ETFs, we thought it prudent to reflect on how 2803 HK and 3173 HK have done since launch, as well as take stock of China A-shares markets overall. In this note, we’ll recap the ETF performance and tracking, review China A-shares over the last 12 months, explore which factors worked and didn’t and offer a few thoughts about our expectations going forward. Thanks as always for reading and trusting us with your investments.

Nov 08, 2018

Premia 圖說

朱榮熙

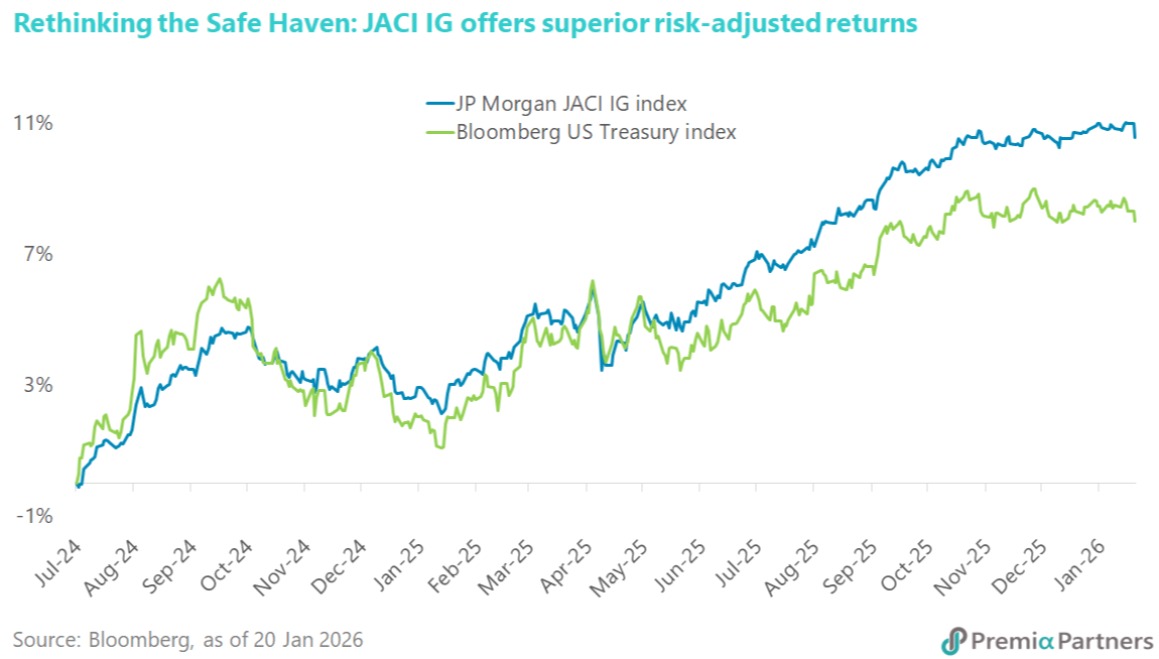

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026