주요 인사이트 & 웨비나

Most asset classes did not perform well so far this year amid the rising interest rate environment and the Ukraine-Russia conflict, e.g., -12.8% in developed market equities, -10.1% in emerging market equities, -4.0% in global bonds, -29.1% in cryptocurrencies. The only exception was commodity, which went up over 32% year-to-date. Crude oil prices keep getting higher with no sign of a pullback in near-term, leading to a mounting inflation pressure to the global economic recovery. Investors are now thinking hard to reallocate their assets and shift away from the risky exposure. Riding the commodity rally by increasing the position in oil or gold may be one of the options, but the usual high volatility and negative carry are always the obstacles for placing any significant bets.

Mar 16, 2022

2021 has been a challenging year for many, with significant divergence within the Chinese equities universe and frequent growth/ value factor rotations through each quarter. We had also experienced regulatory and policy headwind and tailwind that drove significant market movements. Since the end of 2021, China’s equity market has experienced correction which has brought valuation back to attractive level. Both our Premia CSI Caixin China New Economy ETF (3173 HK) and Premia China Bedrock Economy ETF (2803 HK) continue to provide effective diversification tools to global investors and we illustrate a 50/50 blended portfolio that would outperform the broader market and its peers consistently.

Mar 02, 2022

[Watch Now]The US Federal Reserve has signalled the imminent start of the transition from the Great Stimulus of 2020-2021 to policy tightening with rate hikes and tapering at a suggested pace that was at the high end of previous expectations. On the contrary as we kickstarted 2022, China has cut rates and it is expected that more easing measures would be introduced. Meanwhile foreign investors have also shown unprecedented appetite for Chinese government bonds as foreign holdings surged from less than 3% in 2016 to 10.8% at the end of 2021. Would this continue? What would be the outlook? What are the tailwind and headwind factors to consider for investors and asset allocators? Data & Venue23 Feb 2022, Hong Kong Opening RemarksPhoebe Leung, Senior Vice President, Head of Sales & Marketing, Bond Connect Company Limited Panel Discussion - CGB and RMB - 2022 Outlook and Allocation StrategyTracy Yeung, Assistant Vice President, Sales & Marketing, Bond Connect Company Limited (Moderator)Laura Lui, Partner & Co-CIO, Premia Partners Company LimitedChun Hong Chan, Partner, Co-Chief Executive Officer, CIO, Multi-Asset Strategies and Head of External Managers, Avanda Investment ManagementEdmund Ng, Founder & Chief Investment Officer, Eastfort Asset ManagementJonas von Oldenskiöld, Head of SwissRe Korea, former head of SwissRe Asset Management Asia Long Duration CGB ETF - Use Cases, Flows, Liquidity and Trading StrategyDavid Lai, Partner & Co-CIO, Premia Partners Co. Ltd.

Feb 25, 2022

In the US the “triple peaks” in economic growth, earnings growth and policy stimulus will likely result in much lower returns for US equities in 2022. The persistently high inflation – which will likely run hotter in the US than Europe and Japan – is already causing greater volatility as US equities are put on tenterhooks over the timing and magnitude of rate hikes. Meanwhile US Dollar could weaken on inflation rather than strengthen on higher Treasury yields. On the other hand, Emerging Markets, usually do better during periods of Dollar weakness but this time we could see a new twist - this favours China, supported by easier financial conditions. On top of all these, how is the Omicron Virus going to impact the global markets and what are the implications for global asset allocations in 2022? Why ASEAN would be a good diversification within Emerging Markets? Further to Part 1 of our 2022 outlook piece earlier, in this Part 2 sequel our Senior Advisor Say Boon Lim laid out the scenarios and discussed how we can reposition for the global shifts accordingly to address the transition to tightening and pivot from US equities.

Dec 16, 2021

After the smooth sail in 2020, 2021 has been a challenging year for investors with heightened volatility across global markets. Asia Pacific ex-Japan equities, Emerging Asia and in particular China had a good start until mid-February, but then returned all the gains and stayed largely flat on increasing regulatory headwinds in China, extended COVID-lockdowns in southeast Asia, threats of power crunch and credit defaults among Chinese property developers. On the contrary, benchmarks like S&P500, Nasdaq and Euro Stoxx 50 all reached new highs during the year, and Nikkei 225 hit its highest point in three decades. Meanwhile, the divergence in the fixed income markets went the other way, as global fixed income market suffered a mid-single-digit percentage loss in return, while China sovereign bonds bucked the trend with a high-single-digit percentage gain. Where do we go from here? Is the Omicron virus going to reset the path to 2020? And how do we decipher impacts of the Fed tapering, inflation and interest rate expectations, and economic growth and policy trends in China? In this article, our Partner & Co-CIO David Lai assesses the world economics and markets current standings, focusing on China and Asia, and discusses how to reconfigure for new opportunities that arise into 2022 as a year of the new normal.

Dec 08, 2021

Premia Asia Innovative Technology ETF (AIT) since its inception in 2018, was designed to capture the Asia leaders powering the growth of existing and emerging innovative technologies. Without a doubt, the hottest theme trending now is the Metaverse, as Facebook’s CEO Mark Zuckerberg announced earlier that the company name change and sees the Metaverse as the “successor to the mobile internet”. While this is still an emerging but quickly evolving topic, there are already considerable number of Asia leaders active in the space as emerging metaverse natives. How can investors position for opportunities early in this space?

Dec 07, 2021

Vietnam has been one of the best performing markets this year surpassing even the US markets. With increased vaccination rate and lowering new infection cases, recently the government has also eased covid restrictions and lifted social distancing curbs across the country allowing business to resume economic activity

Dec 01, 2021

The regulatory crackdowns in China across multiple sectors have unnerved many international investors. Is China still investible for international investors? How should we configure for China opportunities in the new normal? Are megatrends still relevant going forward? In this webinar, Kinger Lau, Chief China Equity Strategist at Goldman Sachs, Xin Li, Managing Editor of Caixin Global joined our Partner & Co-CIO David Lai to share more about the manifestation of ESG and common prosperity from investment perspectives, and sectors that would be under multi-year policy headwinds and tailwinds under the 14th Five Year Plans. Please message us if you would like to watch the replay, and for a similar session on Oct 26 with David. please register HERE.

Oct 13, 2021

The recent regulatory crackdowns and power suspension in China have unnerved many international investors. How to configure for opportunities under the lens of common prosperity and China’s commitment for carbon neutrality by 2060? In this article, we compare the Premia China STAR50 ETF (3151.HK) and Premia CSI Caixin China New Economy ETF (3173.HK), and discuss why they are useful implementation tools to capture long term opportunities in hardcore technology and strategic new economy sectors under the 14th Five Year Plan.

Oct 12, 2021

The US Federal Reserve has signalled the imminent start of the transition from the Great Stimulus of 2020-2021 to a period with new uncertainties. The Fed’s suggested pace of tapering quantitative easing was at the high end of expectations. In this article our Senior Advisor Say Boon Lim discusses his thoughts on what to expect regarding US inflation rate and 10Y UST yield, and why we need to brace for more challenging US equity and bond markets with lower return and higher risk coming up on the horizon.

Oct 05, 2021

토픽별

주간 차트

Alex Chu

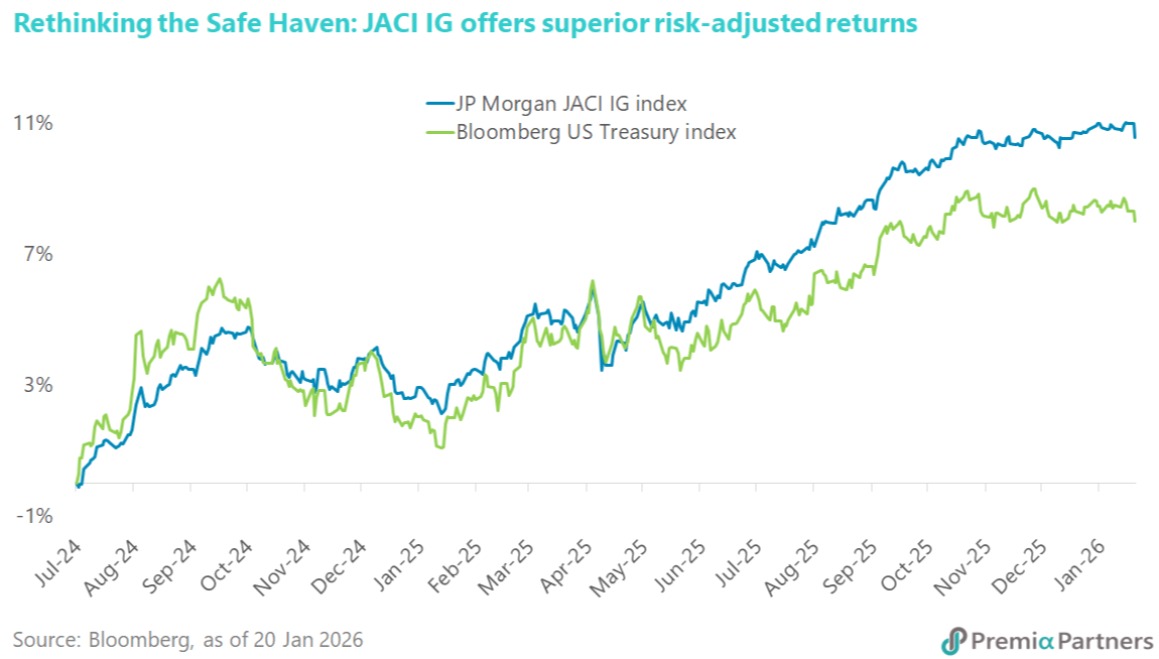

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026

![[Bond Connect x Premia Partners Webinar] Chinese Government Bonds - Outlook and Investment Case for International Investors](https://etfprod.premia-partners.com/articleImg/pic/220301165134068.png)

![[Premia Webinar] Vietnam 2022 Outlook](https://etfprod.premia-partners.com/articleImg/pic/211125124553247.jpg)