주요 인사이트 & 웨비나

We review the history of Chinese consumption over the last 30-40 years and explain why we believe the Chinese consumer holds the key to global economic growth, not just in China but in every country connected to international markets.

Nov 11, 2019

Investors like to conceptualize mega trends into investment themes, which fund managers use to identify strong companies based on top-down investment approaches with a focus on broader, macroeconomic themes. New investment themes always emerge from time to time, such as dot.com around the millennium, social media & robotics in the past decade, or sharing economy & artificial intelligence not long ago. What do they have in common? Technology! A sudden shift in technology would make transformative changes that redefine work processes, rewrite the rules of competitive economic advantage, and eventually the structural breakthrough will bring the potential output to the next level. That’s why market is interested to find out if 5G is a crucial investment theme.

Nov 05, 2019

“Think about what is happening worldwide right now. The US is dragging down global growth by attempting to impose trade tariffs everywhere, China is facing a major economic slowdown, Japan continues their third “lost-decade”, Germany is heading into recession, and the UK is still debating with EU about the way of Brexit. These are just the highlights of how the top five economies are doing, not even mentioning the more troublesome territories such as Italy and Argentina which may have to deal with their escalating debt problems. These markets accounted for more than 70%-80% of the global stock markets depending on which particularly benchmark one is using to measure against the performance. The issue gets more complicated when the US market, weighting over 50% in most clients’ equity portfolio, seems to be exhausted after recording the longest bull run in history whilst still hovers at all-time high. The most imminent question among investors is where to find the peace in the midst of the storm.”

Oct 22, 2019

The US-China trade dispute rumbled and concerns over global growth continued to mount in Q3. Factor-wise, Quality continued to outperform while Value is trailing, badly. Overall, the China A-shares ended roughly flat in Q3, and it was a meaningful quarter to the market with MSCI, FTSE, and S&P Dow Jones all made announcements of (further) inclusion of China A-shares into their benchmarks. Heading into Q4, we believe “Megatrends” continue to be the key investment themes and “Diversification” core to portfolio risk management. We don’t see a Value trap environment, but the comeback relies on many catalysts amid the current market uncertainties. Consolidation will happen as China rebalances to a “new normal”, and we believe Quality Growth is the best approach to capture domestic champions.

Oct 21, 2019

When over 30% of the investment-grade bonds are selling at a negative yield, the longest bull market in the US seems to be wobbling, global growth is decelerating and the two biggest economies are in a dispute over trade and technology, there is a need for most investors to anchor themselves in a stronghold to face the volatile markets. Benjamin Graham’s Intelligent Investor, often referenced as the best book on investing ever written, may be able to offer a bit of insight for us. At the end of the day, an intelligent investor is a realist who sells to optimists and buys from pessimists. The author has experience to back it up: Graham's personal losses in the 1929 crash and the Great Depression led him to perfect his investment techniques.

Oct 18, 2019

Forget about Donald Trump – this is what the markets are really worried about. Forget about the Trump Impeachment. That’s a sideshow. It will get sordid but Democrats won’t get rid of Donald Trump without the support of two-thirds of the Senate. That’s unlikely to happen, given currently available information about the President’s activities. At most, the impeachment inquiry will contribute to the political point-scoring of the 2020 Presidential Election. The greater decision facing investors now is whether they are prepared to put more money down on renewed quantitative easing in Europe and eventually the United States – a phenomena that will simultaneously feed asset markets and distort resource allocation around the world.

Oct 03, 2019

What’s behind China A-shares recent rally? Why are new economy stocks seemingly in the lead after more than 3 years of underperformance?

Sep 18, 2019

Looking for a high conviction basket of Asia growth opportunities? We have a solution for you! Premia Asia Innovative Technology is a diversified, transparent, cost-efficient strategy capturing 50 Asia innovation leaders, and it is a basket of stocks favoured not only by analyst consensus but also many long-term investors including leading sovereign funds and private equity firms. Apart from the well-known BATJs, this vibrant region is also home to many other innovative companies such as the new e-commerce disruptor Pinduoduo and the photon technology evergreen Hamamatsu.

Sep 05, 2019

Market has been focusing on the export side of Vietnam and how it will benefit from the trade war in the past few months. Of course, that is happening and more foreign companies from garments, furniture, packaging to electronics are setting up their factories in Ho Chi Minh, Honai, Bac Ninh, Thai Nguyen, etc. We, however, think it is worthwhile to consider another side of the growth story here: domestic consumption. The continuing economic growth, rising of middle class, and increasing urbanization will all help consumption to grow significantly in Vietnam ahead.

Aug 26, 2019

A new equities downtrend is likely to have started and the coming months will be treacherous to navigate. They will be marked by violent swings, driven in turn by fear of recession and renewed monetary easing. Yet ultimately, markets are likely to see lower lows, driven by the likely failure of policy makers to nullify economic and market cycles. We are suggesting six different strategies to help investors ride out the storm.

Aug 23, 2019

토픽별

주간 차트

Alex Chu

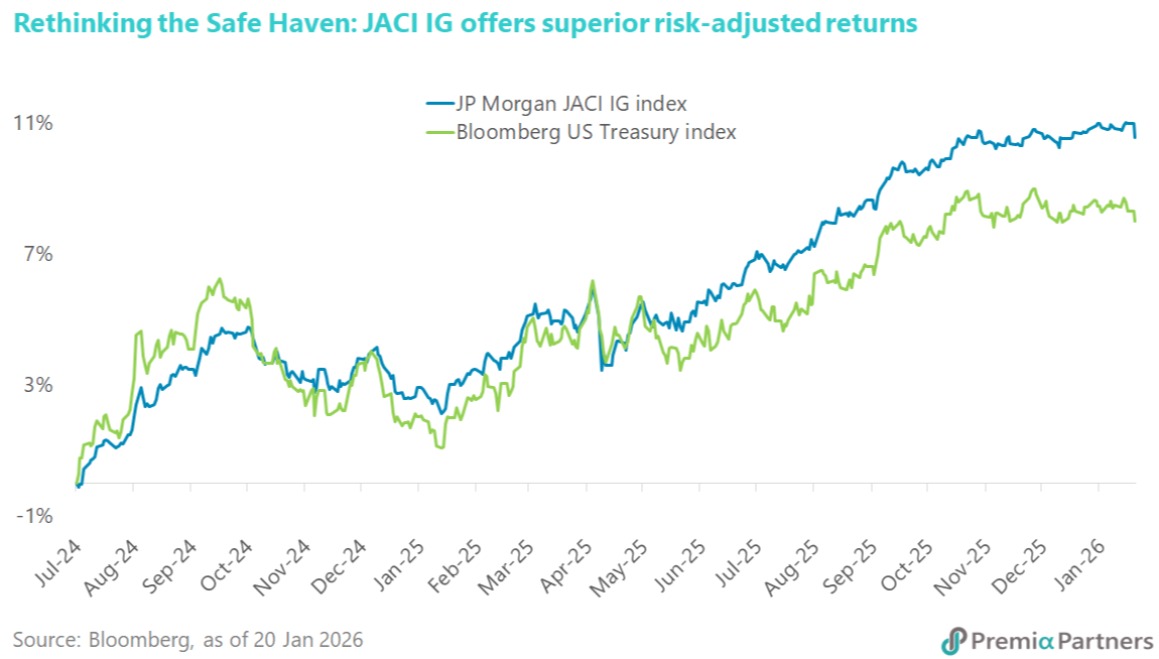

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026