精選觀點 & Webinar

即使是不玩電動的人,也肯定會知道最近在全球爆紅的switch遊戲動物森友會。事實上,電玩產業的規模非常巨大,市場規模已經超過10億美元,受疫情影響,大家持續保持社交距離且居家時間拉長,電玩也成為大家排憂解悶的重要途徑。截止2019年底,全球遊戲市場收入已經超過1500億美元,而其中45%來自智慧型手機和平板電腦上的手遊。在電玩產業中, 電競在過去十年已經發展成一個重要的行業。全球電競收入估計在今年會超過10億美元,而中國目前佔其中的20%。本期webinar,我們將與大家分享「社交距離」下的虛擬世界:中國的遊戲、電競和直播產業。

May 08, 2020

The COVID-19 pandemic has slowed down productivity and daily lives, stagnated the global supply chain, and affected financial market returns across almost all asset classes. In the first quarter of 2020, all markets around the world reported negative returns with varying degrees. While it seems that all is going the same direction, especially in the equities’ world, the fundamental risk factors were not. Among the fundamental factors we employ for China A shares, some has performed better than others amidst the market drawdown.

Apr 28, 2020

Premia CSI Caixin China New Economy ETF performed well and went up by 3% in a down market. In this article, we would like to share with you the reasons behind the strong performance and the comparison of this strategy with the other mainstream indexes that investors usually track in respect to performance attribution, sector allocation, niche thematic exposure and top drivers.

Apr 24, 2020

疫情衝擊下,中國推出40萬億人民幣的「新基建」計劃振興當前經濟,「#新基建」因而頻頻炒上熱搜榜,點燃市場廣泛關注及業界討論。「新基建」到底為何?「新基建」概念股又該從何下手?

Apr 17, 2020

The market performance of gold in the midst of the COVID-19 crisis has left its fans a little puzzled. From a peak of USD 1703 on 9 March, it retreated to USD 1451 on 16 March - a 15% decline. Should one hold gold now, or rather park in cash tools? Our senior advisor Say Boon Lim demystifies in this piece.

Apr 14, 2020

As global asset prices have slumped on the back of the COVID-19 outbreak, concerns have arisen from supply chain disruptions to about global recession and a liquidity crisis. In this webinar, David Lai and Larry Kwok would discuss the lessons learned from the GFC, share our observations of some pandemic-led trends and implications, and suggest a few related investment ideas.

Apr 13, 2020

The COVID-19 outbreak has led to a worldwide pandemic, a global slowdown, arguably a recession and hopefully not a depression. Business activities globally have been halted due to the outbreak and demand has been shrinking significantly as well. Apart from some of the Asian countries including China, we have yet seen an inflection point of the case curves in most countries. In this article, we’d like to share some notable leading Chinese players in the space that have been working hard to fight against the virus for the domestic and global community.

Apr 03, 2020

The virous outbreak becomes one of the largest threats to the global economy and financial markets in decades. Will China, the one which has been suffered from the pandemic first, be able to bounce back first and lead the recovery worldwide like the Global Financial Crisis back in 2008? The latest call in new infrastructure investment maybe the key.

Mar 20, 2020

COVID-19 spread accelerating in the US, even as the number of new infections in China eases Impact will be significant on the largely consumer-driven US economy Markets are either in or on the brink of bear territory, and this is an angry bear Recession likely already in progress in Japan; possible recession in Europe; near zero GDP growth likely in the US by 2Q20 Corporate credit protection costs have started rising – more trouble ahead Seek safety in cash and US Treasury-related instruments

Mar 10, 2020

The coronavirus situation in China seems to have improved a lot, and now many are worried about what will happen as the factories get back on their feet. How's the progress so far?

Mar 10, 2020

Premia 圖說

朱榮熙

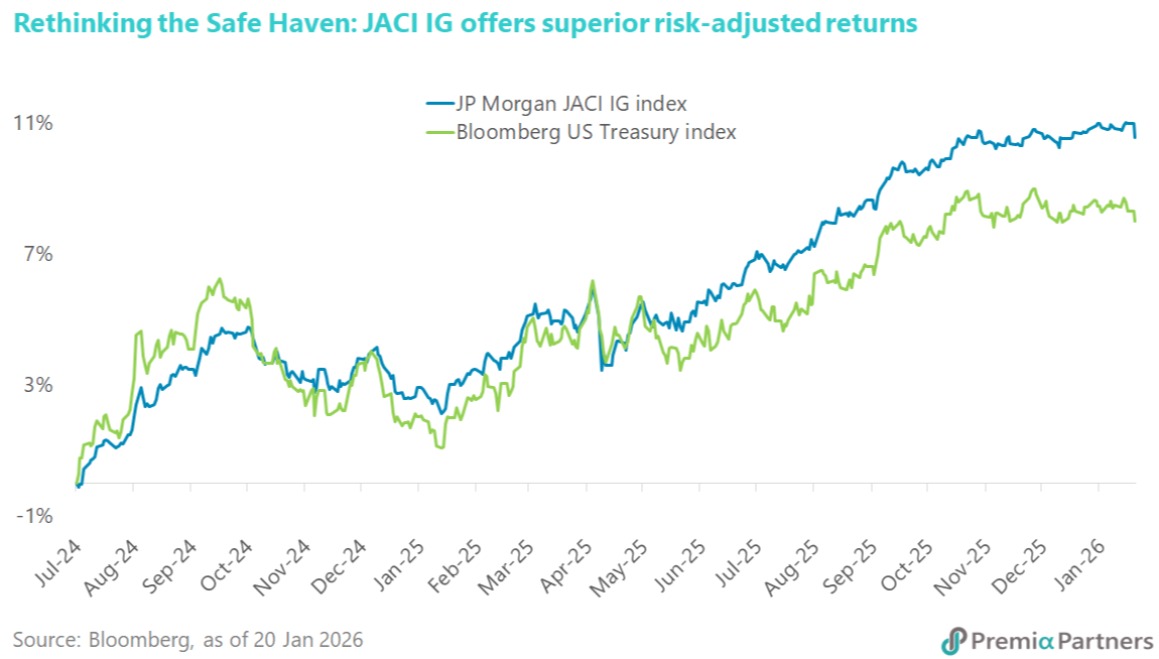

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026