주요 인사이트 & 웨비나

The only major economy to grow in 2020. China has turned adversity from the COVID-19 pandemic into the best growth performance in the world for 2020.

Jan 27, 2021

According to the United Nation Environment Programme, an inclusive green economy is an alternative to today's dominant economic model, which exacerbates inequalities, encourages waste, triggers resource scarcities, and generates widespread threats to the environment and human health.

Jan 22, 2021

The US Federal Reserve pumps out an endless stream of zero interest rate money to finance the Government’s deficit spending. The handouts make most American workers better off financially during the pandemic than before. Meanwhile, the stock market soars. Not bad for the worst pandemic in 100 years. What can possibly go wrong?

Jan 20, 2021

We see the need to evolve from conventional geography centric or factor-based asset allocation models to sector and megatrend-minded models to capture secular alpha from structural changes.

Jan 13, 2021

The red-hot performers of the past 12 months have been the broad market indices from North Asia – Kospi (44%), CSI 300 (34%), TWSE (30%)

Jan 12, 2021

2021년을 맞이하는 시작하는 시점에서, 그리고 여전히 코로나 바이러스와 저금리가 지속되는 상황 속에서, 저희는 아시아 지역의 성장을 바라보고 있습니다.거대한 중국 그리고 한국, 일본, 대만 등 글로벌 기술 경쟁력을 갖춘 국가들과 베트남에 이르기까지, 시장 전망과 함께 프리미아가 준비한 메가트렌드 기반 ETF 투자전략을 꼭 한 번 만나보시기 바라겠습니다. (웹세미나, 20분 이내)

Jan 04, 2021

Outperformer from first news of successful vaccines. Emerging ASEAN has been one of the best performers among major global equity indices since the start of November. And that was likely due to the region’s high economic leverage to normalisation after the distribution of COVID-19 vaccines and its high trend GDP growth rates relative to other Emerging Market economies.

Dec 24, 2020

Global equities look likely to push higher in 2021, despite the pandemic’s economic and human toll.

Dec 23, 2020

To summarize the year of 2020, the opening lines from Charles Dicken’s A Tale of twin cities sounds like an accurate description. It was certainly the best of times and the worst of times. Global equities have been doing reasonably well with developed market up by 12.0% and emerging market up by 11.7%. Fixed income managed to gain by 7.4% whilst gold price was up by 19.1%. On the other hand, real economy has been suffering from the pandemic with almost all major economies getting into recession. International Monetary Fund sees the world would contract by 4.4% in total output, the worst crisis since the 1930s Great Depression with -5.8% among advanced economies and -3.3% on developing countries.

Dec 02, 2020

From a total portfolio perspective, global asset owners and allocators are increasing wary about the overall portfolio sensitivity to interest rate changes and ultimately risk diversification. The concept of “equity duration” was raised long ago and has been subject to debate for decades. While some absolute calculations fail to work in today’s markets, we believe the economic and financial intuition beneath still hold. In this working paper, we took a renewed approach to analyze the relationships from a relative perspective and with an overarching objective of total portfolio risks in mind.

Nov 26, 2020

토픽별

주간 차트

Alex Chu

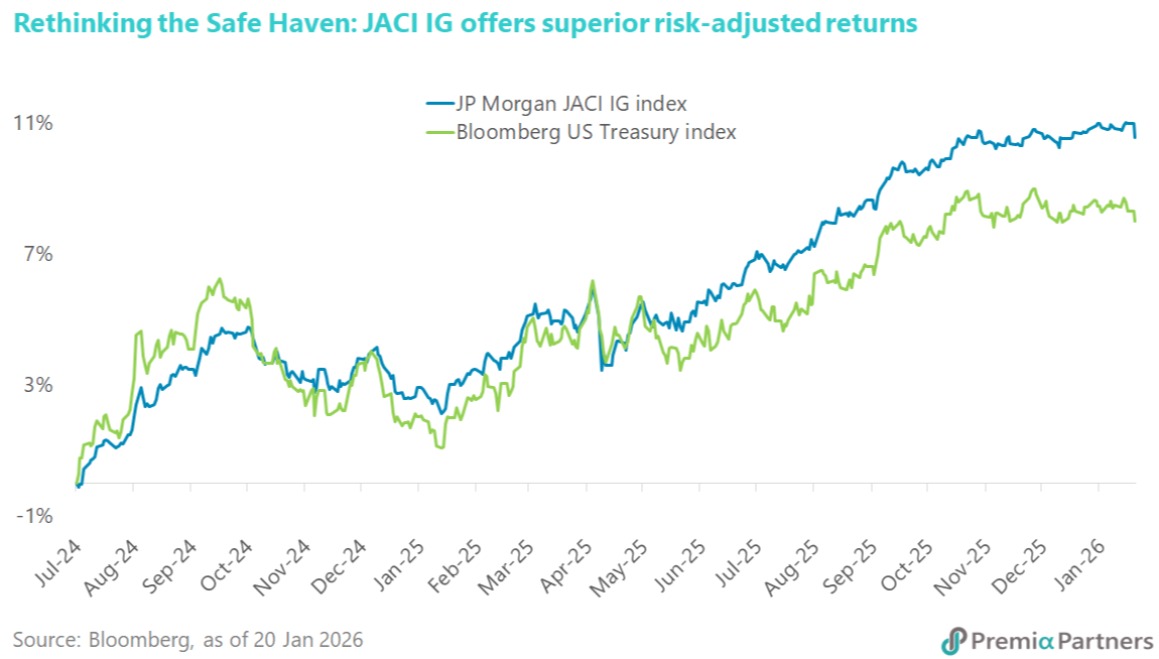

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026