주요 인사이트 & 웨비나

A major global trading and geopolitical event happened last week, attracting relatively little commentary from a media more preoccupied with US politics and the pandemic.

Nov 24, 2020

As business activities in China mostly resume to a normal level, we also observed some mean-reversion in factor returns, and interesting rotation in sector returns. Still, China A shares continue to outperform the US and global equity markets. With “high-quality” growth emphasized by the 14th Five-Year Plan and “Dual Circulation”, we believe “Quality Growth” will continue to be the main tone of China A equities.

Nov 11, 2020

So, it is official: Exit Donald Trump, enter President Joe Biden. And when the cheering and crying is done, we are likely to see that the election meant more emotionally to Americans than it does economically for the nation, or financially for the markets. The big economic and market trends are unlikely to be changed by the election.

Nov 09, 2020

China’s 14th, Five-Year Plan is a refreshing reiteration of conventional supply side policies, at a time when Developed Markets are in the grip of very unorthodox economic policies.

Nov 04, 2020

The term "dual circulation” is one of the hot searches in China and receives great attention after President Xi first expressed this idea at a top official meeting held earlier this year. He then elaborated further that China’s economic model will be involving an internal circulation developing a substantial domestic market, and an external circulation deepening the international trade. The latest meeting of Communist Party’s Central Committee reinforced this policy will be the core component of the 14th five-year plan for the development between 2021 and 2025.

Nov 04, 2020

The latest economic data confirms the upward trajectory of Chinese growth, putting China on track to be the only major economy to register growth for the full year 2020. And it highlights the attractiveness of China’s asset markets and supports the case for continued outperformance against other major markets.

Oct 28, 2020

Two separate news items last week focused our attention on the gap in understanding about the rapidly changing energy landscape in China.

Oct 20, 2020

Yield curve steepening – which has been accelerating in recent weeks as the market contemplates a whopper of a stimulus package under a possible Biden White House – is likely to continue regardless of the winner on November 3.

Oct 14, 2020

Since COVID we have observed that many constituents in our Premia ETFs have been silver lining beneficiaries and continue rallying notwithstanding the market volatilities, unfolding COVID situation and US China tension. Here we share the conversation with our Co-CIO David Lai and team, on some frequent topics that come up often in our client conversations, especially around China new economy ETF (3173/ 9173 HK), which registered strong YTD return* of ~40% and have become the 4th largest A shares ETF in Hong Kong as consistent inflows since April tripled its AUM to ~US$285 million.Please click here for transcript to the disscussion.*as of October 12th 2020

Oct 14, 2020

토픽별

주간 차트

David Lai , CFA

CFA

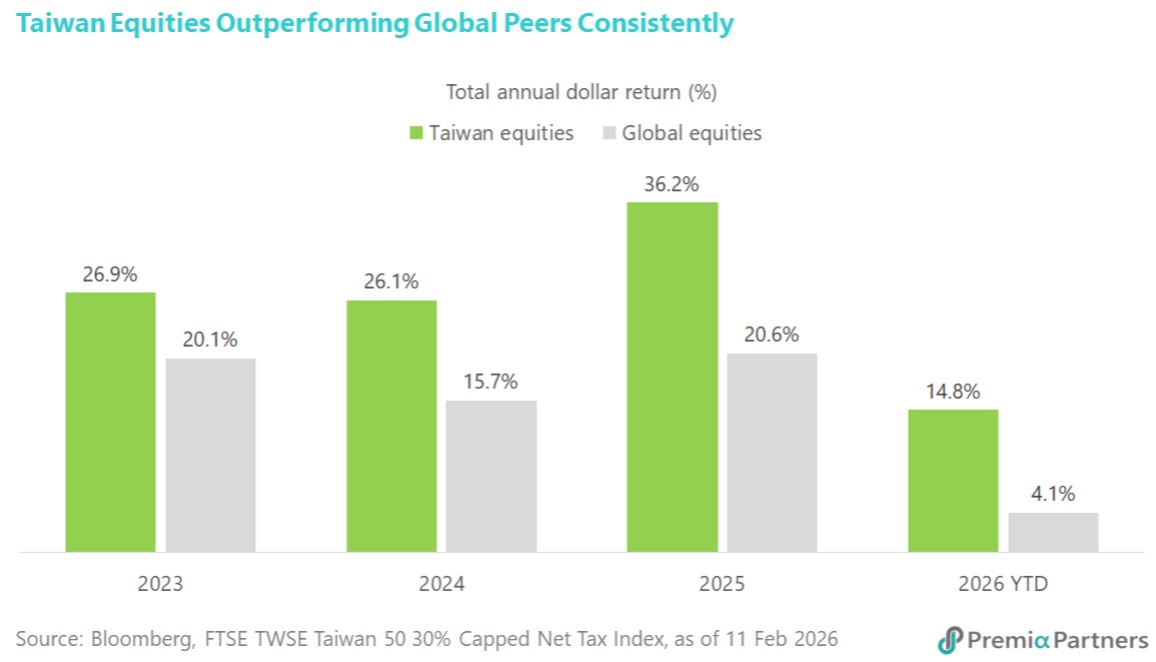

Taiwan's economic outlook is experiencing a significant uplift, driven by the burgeoning AI revolution and a recently cemented trade pact with the US. Economic growth forecasts for this year have been upgraded to an impressive 7.7%, a substantial increase from the 3.5% projection made in November. This revised outlook anticipates Taiwan's GDP reaching an unprecedented USD1tn, marking a historic achievement for the island. Fueling this robust growth is an expected surge in exports, now projected to rise by 22.2% in 2026, a sharp acceleration from the earlier 6.3% forecast. These positive revisions reflect a broad consensus among financial institutions, with Bank of America nearly doubling its growth prediction due to “relentless global demand“ for Taiwan's advanced tech hardware, including critical AI chips and servers. The enhanced capital expenditures by cloud providers, exceeding initial expectations, further underscore the formidable strength of AI-related infrastructure. The strategic trade agreement finalized between the US and Taiwan earlier this month is a pivotal catalyst, set to reduce average tariff rates on Taiwanese exports to the US from nearly 36% to ~12%. This landmark deal, hailed as a shift from “defense to offense“ by Taiwan Premier Cho Jung-tai, will cement Taiwan’s position as an economic powerhouse. The tangible impact of these developments is already visible in Taiwan's equities market, which has seen remarkable performance. The stock market has advanced by at least 25% for three consecutive years, with a further ~15% gain to a new record in 2026 alone. For institutional investors looking to capitalize on this strong structural uptrend in Taiwan equities, the Premia FTSE TWSE Taiwan 50 ETF presents an optimal and strategic investment vehicle to capture this solid growth story.

Feb 23, 2026