주요 인사이트 & 웨비나

The Chinese economy continues to normalize across the board at an impressive rate, leading to the strong likelihood of it beating the current Bloomberg consensus GDP estimate growth rate of around 2% for 2020.

Oct 06, 2020

The COVID-19 pandemic could accelerate new thinking about Emerging Markets in asset allocations.

Sep 23, 2020

China economy recovered faster than the rest of the world from the pandemic as shown by various economic indicators ranging from official PMI, GDP number, steel output, excavator sales, to traffic data. China’s solid macro recovery stands out from the rest of the major economies which either remain in a lock-down mode or simply begin to resume economic activities. That explains Chinese listed companies outperformed in terms of earnings and stock price performance.

Sep 10, 2020

An overdue technical rebound in the US Dollar – which started a week ago – may give investors an opportunity to diversify their currency holdings away from the Greenback. What is emerging could well turn out to be a counter-trend rally in a bigger, multi-year Dollar decline.

Sep 09, 2020

CSI 300 outperforms S&P 500, Chinese tech outruns Nasdaq 100. How has China’s new economy sectors including its recently launched “Nasdaq” – the STAR board (Shanghai Stock Exchange’s Science and Technology Innovation Board) – outperformed global indices despite being at the center of a trade-tech war with the United States?

Sep 01, 2020

Highest recorded yield spread between the China 10Y Government Bond and the 10Y UST. The yield spread between the China 10-year government bond over the 10-year US Treasury recently hit its widest ever recorded level.

Aug 25, 2020

In the midst of a US tech bubble, Chinese and Hong Kong equities have emerged in the sweet spot between valuations, profitability and balance sheet strength.

Aug 18, 2020

Are US indices rallying because of COVID-19? The most common narrative is that “US stocks have been rising despite the pandemic.” Perhaps a more accurate explanation is “US stocks have been rising because of the pandemic”.

Aug 12, 2020

After the fall in Q1, global equities recovered sharply in Q2 as the COVID fear eases and stimulus packages kick in around the world. YTD, China is the best performing emerging market, and the broad CSI 300 index gained 14% in the second quarter. From factor investing perspective, we continue to see the dispersion of a two-speed-economy despite an overall beta pick up. Quality growth new economy stocks continue to be the winner.

Aug 11, 2020

Back to the future. Clues to US policy makers’ long game for the Dollar can be found in the long-term historical relationship between money supply growth, the inflation rate, and nominal GDP growth. Conclusion upfront: We are likely to see a long cycle of aggressive US monetary expansion ahead – to depreciate the Dollar, revive inflation, and boost nominal GDP growth.

Aug 03, 2020

토픽별

주간 차트

Alex Chu

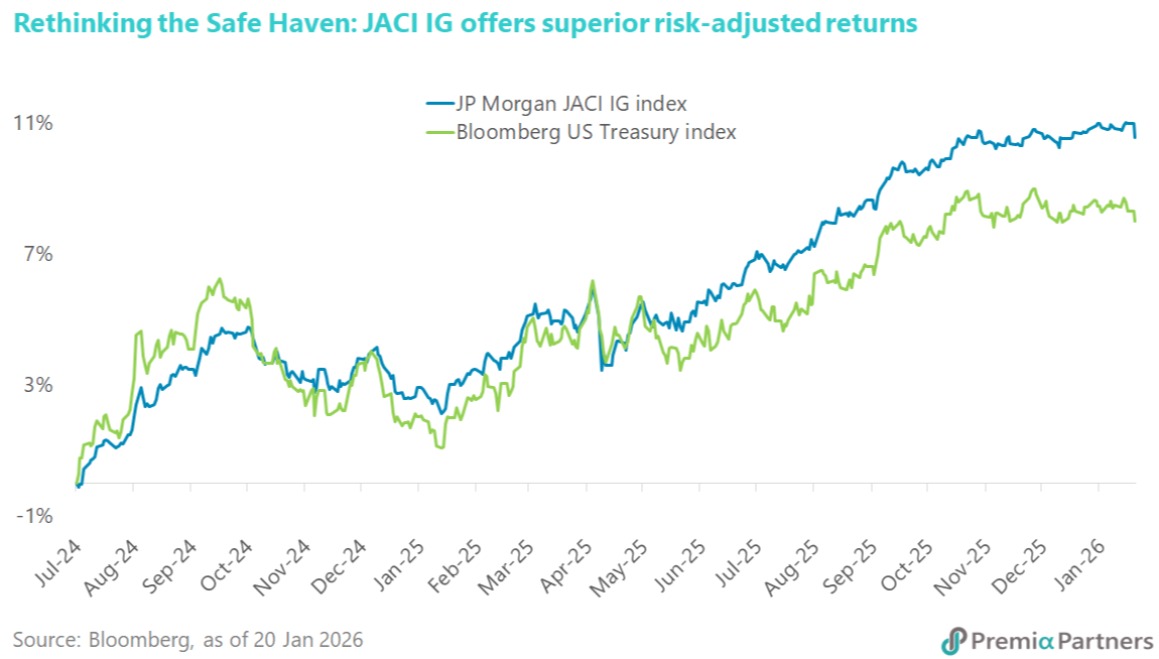

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026