精选观点 & Webinar

After the fall in Q1, global equities recovered sharply in Q2 as the COVID fear eases and stimulus packages kick in around the world. YTD, China is the best performing emerging market, and the broad CSI 300 index gained 14% in the second quarter. From factor investing perspective, we continue to see the dispersion of a two-speed-economy despite an overall beta pick up. Quality growth new economy stocks continue to be the winner.

Aug 11, 2020

Back to the future. Clues to US policy makers’ long game for the Dollar can be found in the long-term historical relationship between money supply growth, the inflation rate, and nominal GDP growth. Conclusion upfront: We are likely to see a long cycle of aggressive US monetary expansion ahead – to depreciate the Dollar, revive inflation, and boost nominal GDP growth.

Aug 03, 2020

COVID-19 will likely go down in history as – among other things – an accelerant for a range of tendencies are already present prior to the pandemic. AC (after-COVID), these are the four major behavioral changes that are unlikely to revert to life as we knew it BC (before-COVID).

Jul 21, 2020

The international media reckoned a front-page editorial in the China Securities Journal calling for a “healthy bull market” to create “new opportunities in crisis” was responsible for last week’s red-hot run-up in the Shanghai Composite Index. But perhaps there are less “exciting”, but more enduring, explanations for the surge in Chinese stocks.

Jul 13, 2020

Fed bond buying won’t prevent the coming wave of debt defaults. It may have been missed in the midst of the stock market’s bullishness, but debt defaults have already been surging. How does the Fed’s USD 750 billion bond buying programme measure up to the job? And what shall we watch out for?

Jul 08, 2020

Opportunities in quality growth leaders: China and Asia Innovative TechnologyThe world has been put to significant challenges and changes by COVID-19, which redefined economic growth and investment opportunities for investors.After winning the HKEx 2019 Top Performing ETF award with 45.2% return, the Premia New Economy ETF continued to be the rare strategy that scored strong positive YTD performance. What drives the resilience?Rather than just IT and internet, China New Economy and the sister version in Asia Innovative Technology sector leaders cover the major beneficiaries as megatrends opportunities in Urbanisation, Rising middle income class, Consumption upgrade, Aging population and rising need for healthcare, digital transformation in both To-C and To-B space, and technology enabled industrialisation 4.0 unfold.In this presentation, we discussed the two ETF strategies that aim to better capture the emerging growth markets and emerging growth sectors in China and Asia.

Jun 26, 2020

Opportunities in quality growth leaders: China and Asia Innovative TechnologyThe world has been put to significant challenges and changes by COVID-19, which redefined economic growth and investment opportunities for investors.After winning the HKEx 2019 Top Performing ETF award with 45.2% return, the Premia New Economy ETF continued to be the rare strategy that scored strong positive YTD performance. What drives the resilience?Rather than just IT and internet, China New Economy and the sister version in Asia Innovative Technology sector leaders cover the major beneficiaries as megatrends opportunities in Urbanisation, Rising middle income class, Consumption upgrade, Aging population and rising need for healthcare, digital transformation in both To-C and To-B space, and technology enabled industrialisation 4.0 unfold.In this presentation, we discussed the two ETF strategies that aim to better capture the emerging growth markets and emerging growth sectors in China and Asia.

Jun 26, 2020

For Premia CSI Caixin China Bedrock Economy ETF (2803.HK), there were 90 changes among the underlying index constituents during the latest rebalancing in June. The one-way turnover ratio was 33.5%, in line with the historical range between 30% and 40%. The value factor continued to work well with the ETF becoming more attractive in terms of valuation by replacing overvalued stocks with undervalued one. The forward price-to-earnings ratio dropped from 8.1x to 6.3x whilst the price-to-book ratio remained at 1.1x. The quality factor also functioned as designed with both return-on-equity ratio and profit margin increased post-rebalancing. The former rose from 8.9% to 9.7% and the latter increased from 11.3% to 13.6%, reflecting the current stock pool is healthier in financials and stronger in profitability. In addition, the low-volatility screen did help reduce the portfolio’s risk, as shown by the volatility falling from 29.5% to 28.9%. Last but not least, the index’s revenue rose from RMB 19.1 billion to RMB 21.1 billion, capturing the mainstream economy of China. Overall the post rebalancing portfolio represents a basket of constituents with better resilience during the COVID and US China tension induced market growth, with cheaper valuaton, higher ROE, higher profitability, strong debt coverage and lower volatility.From a sector perspective, the major change was reducing exposure in Consumer Discretionary and Industrials, and increasing weights in Financials, Real Estate and Utilities. Drilling down into sub-segments, the additions in Financials are mostly leading banks with attractive valuation, while the deletions in Consumer Discretionary are mostly automobiles related given the challenged fundamentals for the sector. Notwithstanding the market environment, Chinese banks so far have only been affected mildly by the economic slowdown. For example, the industry’s return-on-equity fell slightly from 11.7% to 11.0% and NPL ratio edged up from 1.83% to 1.86%. On a positive note, the net interest margin even surprised on the upside with the number going up from 2.18% to 2.20%. In respect of potential NPL pressure, the additions are also considered with the balancing factor of quality factor, thus focusing banks with robust fundamentals but suppressed valuation during broad market drawdown. Automobile industry was a totally different story with the national sales strinking for the 2nd year in a row. The total vehicle sales fell by 8.2% to 25.8 million in 2019, after having slid nearly 3% in 2018 in the first contraction since the 1990s. The slump was exacerbated by weak economic growth, the trade war with the US and tough new emission standards introduced last summer.For Premia CSI Caixin China New Economy ETF (3173.HK) which has continued the strong trajectory and performed well through COVID and after the rebalancing with YTD ~20% return as of Jun 22nd, it had a higher turnover rate compared to the previous rebalances given the evolution of the new economy trends becoming more pronounced since COVID. There were total 113 replacements, and the one-way turnover was around 45.7%, slightly higher than the historical range of ~40%. As the index methodology prefers companies with light-asset business model, the consistuents showed a slight increment in non-fixed asset ratio from 0.857 to 0.859 post rebalancing. In terms of financial health, the updated basket of stocks reflected a higher quality in general with significant improvement seen in the debt coverage (0.86x to 1.71x), return-on-equity (9.7% to 12.6%), and profit margin (14.6% to 17.3%), representing a more robust set of fundamental staying power for growth given the current market conditions. In fact, this has also been reflected in the resulting strong growth numbers - the index constituents are expected to grow faster with the estimated revenue growth rising from 9.7% to 15.0% after the resuffle. A mid-teen growth rate is indeed impressive amid the macro slowdown and the challenigng COVID-19 impact.From a sector point of view, the major change is an increase in Information Technology versus a reduction in Healthcare and Consumer Discretionary. The additions in Information Technology were diversified into semiconductor, software and communications equipment, which align well with the new infrastructure and Industrial IOT development mentioned in our previous research articles. With the government’s intention to speed up the technolgoical advancement, it is quite rational to see more emerging industry leaders in the capital market. The latest policy expands the conventional infrastructural investment to encompass digital infrastucture aka #New Infrastructure such as 5G network, data centers, Internet of Things and cloud computing are expected to help groom the local champions. On the contrary, the deletions in Consumer Discretionary were mainly auto or consumer-electronic related since consumers were reluctant to make big ticket purchases in an uncertain environment. Besdies, the exports business might also get affected negatively from the rising tensions in global trade.Within Healthcare, the deletions focused on traditional pharmaceuticals which could face more headwinds ahead, in particular for the companies which produce generic drugs. Beijing has been pushing forward a system that requires drugmakers to go through a bidding process and cut prices low enough to be considered over generic copies if they want to sell their products at public hospitals via large-volume government procurement.For Premia Asia Innovative Technology ETF (3181.HK), there were 8 changes out of 50 stocks if excluding Alibaba which switches from the ADR to the shares listed in Hong Kong, due to its re-classification of the primary listing from the US to Hong Kong. Also, each stock is re-scaled back to an equal weight of 2% in the portfolio, following a rebalancing discipline of profit-taking and buying on dip. Among the 8 inclusions, there are 5 Chinese companies, 2 Japanese companies and 1 Korean company covering themes including new infrastructure, media & web services, biopharmaceutical and semiconductors. Only Chinese and Japanese companies are in the deletion list, in which their businesses are mainly related to media & web services, robotics & automation and industry 4.0. Most of the changes in the index were driven by whether the company’s market cap can reach or fall out from the top 50 in the universe.Similar to China New Economy, the post-rebalance portfolio reflects also a basket that resonates well in the COVID/ post-COVID world, where a lot of behavioural changes YTD become permanent phenomena. In terms of sector, although Technology remains the major components, there are some adjustments to the composition reflecting the impacts from the YTD environment. It has shifted some of its weightings from “electronic equipments and hardwares” to “new infrastructure and semiconductors”. The reduction in the former might be partly due to the shift in global supply chain as some multinational corporations have been moving manufacturing bases to the low-cost countries such as Vietnam and Indonesia. The increase in the latter was probablay a result of the policy direction in promoting the domestic competitiveness in technology. Certainly, the stimulus plan in allocating more resources in new infrastructrure also helps the stock performance. For the rest of other sectors like Healthcare, Consumer and Industrials, their respective weightings stayed around the same. The outcome is a diversified basket of innovative technology-enabled leaders across various growth themes, and across currently China, Japan, Korea and Taiwan. Rather than high growth small cap companies or illiquid private companies, these are sector leaders with proven track record, R&D and growth fundamentals, and thus provide a more liquid exposure to the more resilient innovative technology players well positioned to capture the emerging megatrends including consumer and enterprise digital transformation, healthcare/ biotech/ pharmaceutical, and AI, 5G, robotics and industrial automations.

Jun 24, 2020

Although the US Dollar Index DXY is likely to pick up a bit more in coming weeks if equities weaken, the longer-term outlook for the Greenback beyond the acute phase of COVID-19 is bleak.

Jun 23, 2020

In crisis times like the current COVID scenario, when many stocks are at multi-year lows and finding opportunities seems to be challenging, our Premia Asia Innovative Technology strategy has proved to be among the most resilient large-cap thematic strategies that has rebounded well above the pre-COVID level with a YTD return of 7.1% (as of 6/12/2020) while also recently hitting an impressive record-high since its inception in August 2018. In this piece, we decipher for you this strategy’s exposures and why it is (more) relevant to investors, particularly post-COVID.

Jun 18, 2020

Premia 图说

朱荣熙

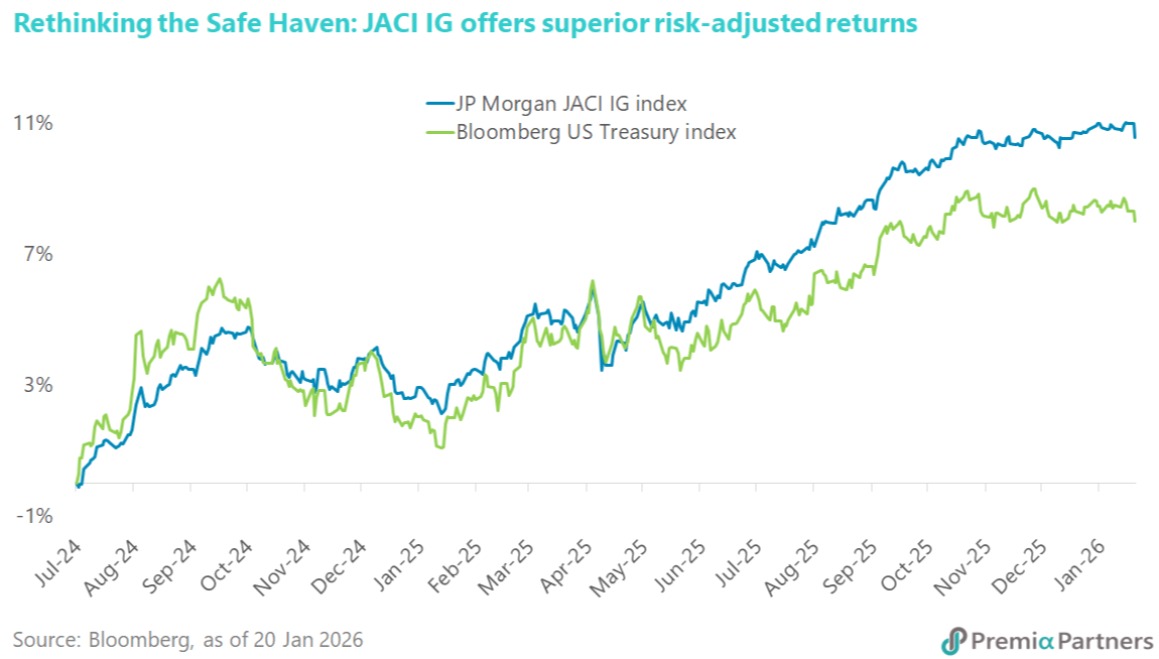

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026